The first week of positive net inflows recorded $105 million for Spot Ether exchange-traded funds (ETFs) in the United States since their inception on July 23.

As per SoSoValue, an ETF tracker, the nine recently launched spot Ether ETFs in the United States experienced positive aggregate net inflows of $104.8 million during the week commencing August 5.

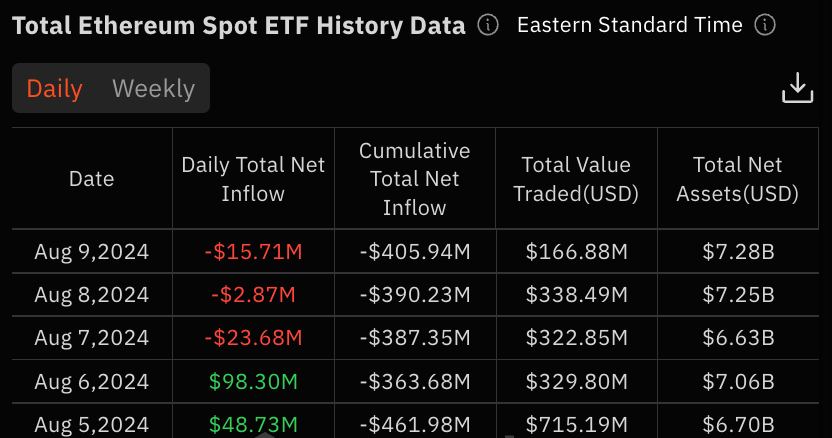

Additionally, the total value of traded assets reached $1.9 billion, bringing the total net assets to $7.3 billion as of August 9.

The fundamental asset, ETH, has experienced a 23% decline in value since the beginning of August, which coincided with the inflow figure.

Six of the nine funds experienced positive net flows for the week, with BlackRock’s iShares Ethereum Trust ruling the pack with $188.4 million.

In just 13 days of trading, the BlackRock fund has amassed more than $900 million and has yet to experience a discharge day.

Last week, Fidelity’s Ethereum Fund, its closest competitor, received $44.65 million in inflows, bringing its total to $342 million.

The VanEck Ethereum ETF, the Bitwise Ethereum ETF, the Franklin Ethereum ETF, and Grayscale’s Mini Ethereum Trust were the other four ETFs with aggregate inflows last week, with $19.8 million, $16.6 million, and $3.7 million, respectively.

The 21Shares Core Ethereum ETF and the Invesco Galaxy Ethereum ETF experienced nil weekly net flows.

If Grayscale’s Ethereum Trust had not experienced $180 million in outflows during the week, the aggregate inflows for the nine ETFs would have been significantly higher.

According to Farside Investors, the total outflow of assets from Grayscale’s spot Ether ETF, currently $2.3 billion, has resulted in an aggregate outflow of $406.4 million for all nine funds.

In the interim, ETF issuers attempt to introduce options products for their spot ETH funds.

On August 7, the NYSE American presented a rule change that would enable it to list and trade options contracts for three ETH ETFs from Grayscale and Bitwise.