BlackRock’s spot Ether exchange-traded fund, also known as ETHA, has increased in its total inflows to about $869.8 million since its launch on July 23.

Investors sought to capitalize on Ether’s 18% price decline on August 5, marking the third-largest flow day for the iShares Ethereum Trust, according to Farside Investors.

According to Nate Geraci, President of The ETF Store, BlackRock’s Ether ETF ranked among the top six best-performing ETFs in 2024 due to the $870 million inflows.

He also mentioned that four top performers, such as BlackRock’s IBIT, are spot Bitcoin ETFs.

BlackRock’s ETHA also acquired $47.1 million during the crypto industry’s “Black Monday,” which resulted in the liquidation of over $600 million in leveraged long positions.

Geraci further stated that ETHA’s combined flows on August 5 and 6 alone place it in the top 10% of ETFs launched in 2024 despite the significant market decline.

Despite the absence of staking returns and options trading from the issuers of spot Ether ETFs, all this was accomplished.

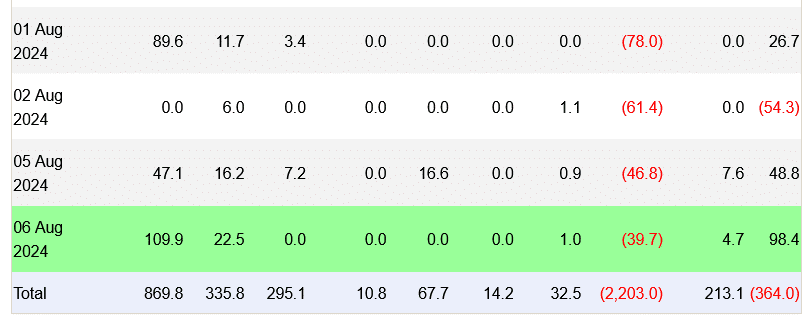

In the meantime, spot Ether ETFs experienced a combined $98.4 million inflow on August 6, their most successful day since their introduction on July 23.

The second largest inflow on August 6 was $22.5 million for Fidelity’s spot Ethereum ETF, while the Grayscale Ethereum Mini Trust and Franklin Ethereum ETF saw $4.7 million and $1 million in inflows, respectively.

Anthony Sassano, the host of The Daily Gwei, an Ethereum program, stated, “TradFi is consuming that ETH.”

ETHE, Grayscale’s Ethereum product with a higher fee, was the sole spot Ether ETF to experience an outflow, with a total of $39.7 million.

The spot Ether ETFs have experienced a combined $473.9 million in outflows, despite ETHA’s robust start, when accounting for the $2.2 billion that has departed Grayscale’s ETHE.

Since bottoming out at $2,197 on August 5, Ether has partially recovered, with a 13.5% increase to $2,494, according to CoinGecko data.