Few days after Sparkpool Ethereum’s second-largest mining pool shut down, BeePool another Ether (ETH) mining pool is also shutting down due to China’s crypto crackdown.

On Tuesday, the China-based Ether mining pool declared that it would cease operations “in light of recent regulatory policies.”

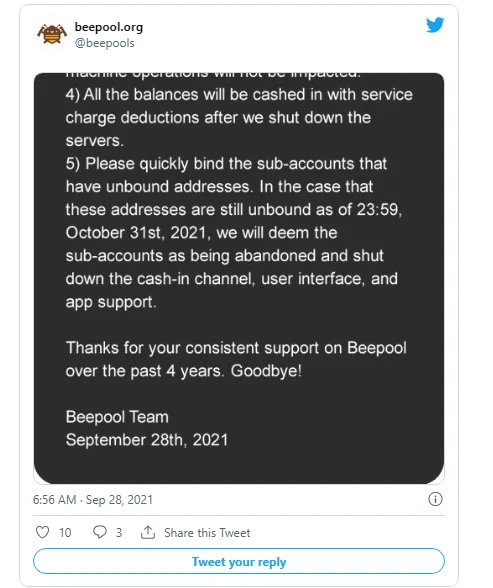

New user registration and the addition of sub-accounts for existing users will be disabled immediately, and all mining access servers are likely to be shut down by October 15.

The news comes only one day after it was announced that SparkPool, the second-largest Ether mining pool, would be shutting down before the end of the month for similar reasons.

BeePool and SparkPool together account for over a quarter of Ethereum’s hash rate.

Late last week, it became evident that the People’s Bank of China was ramping up a suite of new measures and fostering deeper inter-departmental collaboration to suppress crypto activity, following a break-in of its crypto campaign.

The steps are designed to block payment methods and dispose of relevant websites and mobile apps in compliance with the law.

For months, the mining crackdown has been concentrated on Bitcoin (BTC) mining, which has resulted in a significant outflow of mining companies from the country. The Chinese government now looks to be concentrating on Ethereum.

Following a tip, police in the autonomous province of Inner Mongolia seized 10,000 Ether mining machines from a warehouse, according to the Guang Ming media site. The miners used 1,104 kilowatt-hours of power every day.

Inner Mongolian officials, according to the journal, have shut down 45 digital currency mining projects so far, saving 6.58 billion kWh of electricity each year, or the equivalent of 2 million tons of conventional coal.

According to CoinGecko, ETH’s price has dropped below $3,000 as a result of the mining crackdown, and it is presently trading at $2,863.71.

BeePool has been in operation for four years and now controls 6.7 percent of the Ethereum mining market, with over 3,000 blocks mined in the last week.

While mining is currently profitable, the Ethereum London hard fork’s introduction of fee burning has cut earnings, as miners receive fewer incentives for each block.

On Wednesday, the next step in the blockchain’s ongoing upgrade to Ethereum 2.0 was announced, with a release date set for October. The move to proof-of-stake will further marginalize miners.