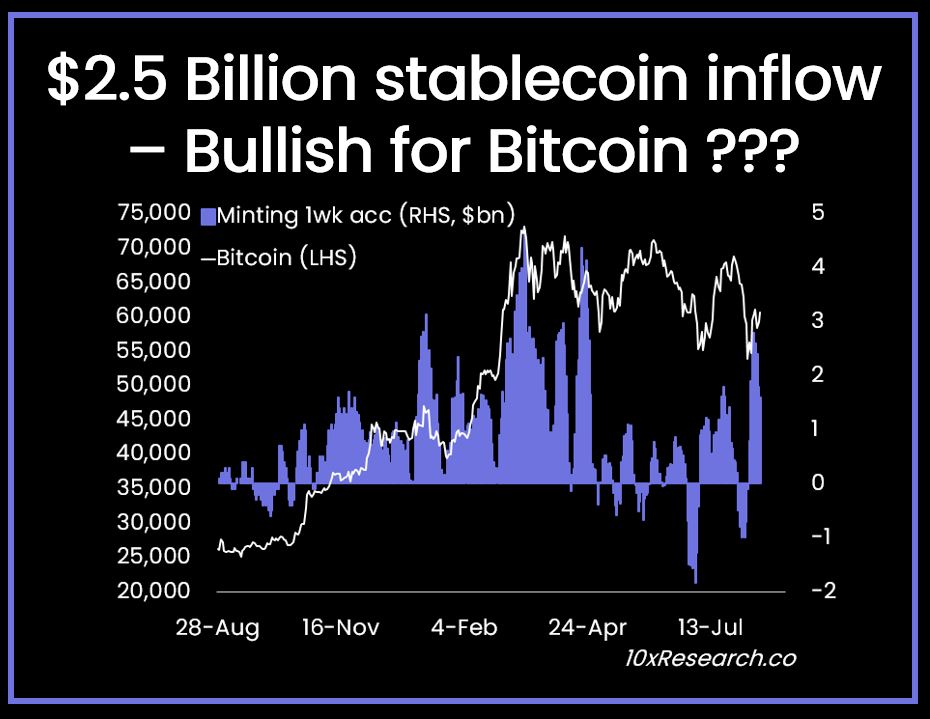

Bitcoin price has surged above $61,000 fueled by $2.5 billion in stablecoin inflows from Bitcoin traders deposits into spot Bitcoin ETFs.

With all eyes on the data about the Consumer Price Index (CPI) in the United States, Bitcoin and the cryptocurrency market as a whole have staged a robust comeback in the recent short covering.

In the midst of the robust stablecoin inflows that have been occurring over the past week, the price of Bitcoin has increased by an additional 3% today, taking it above the $61,000 threshold.

Bitcoin Traders Bet on $2.5 Billion Stablecoin Inflow

Bitcoin traders anticipate a possible bullish impact as a result of the $2.5 billion in stablecoin inflows that have occurred over the past week. According to 10X Research’s findings, Tether and Circle have been lagging behind in the process of creating stablecoins denominated in USDT and USDC throughout the past.

This indicates that institutional investors are prepared to inject new cash into the market. Bitcoin traders think this explains Bitcoin’s recent short covering.

Additionally, the deposit of money into spot Bitcoin exchange-traded funds (ETFs) has significantly increased, indicating the growing demand from institutional investors for the Bitcoin asset class.

In a disclosure to the market, Goldman Sachs, a global financial services firm revealed its $418 million in investment products related to Bitcoin exchange-traded fund (ETF) trading activity for the second quarter.

Since April 2024, 10x Research has indicated that there has been a halt in the flow of money, which has resulted in a subsequent correction in the price of Bitcoin.

On the other hand, the recovery in the money flows that has occurred as a result of the increasing supply of USDT and USDC has provided some support to the cryptocurrency market as a whole.

Additionally, the on-chain data demonstrates that Tether has generated more than one billion dollars in USDT over the course of the past twenty-four hours, and it has also transferred these USDT to centralized exchanges (CEXs) such as Binance, Coinbase, Kraken, and their counterparts.

Crypto Market Recovery Amid USDT, USDC Flows

In the midst of a liquidity comeback, the price of Bitcoin has staged a robust recovery this week, gaining more than ten percent on average across the weekly charts.

Furthermore, the cryptocurrency sector as a whole has seen a similar upward trend, with Ethereum leading the alternative cryptocurrency market.

The developments that have occurred on a global level this week will be crucial in determining the future course of the cryptocurrency market from this point forward.