The acquisition of ETC Group, a crypto investment firm, has enabled Bitwise, an asset manager based in San Francisco, to enter the European markets.

ETC Group, a London-based firm, has a portfolio of products that includes a physical range of crypto exchange-traded products (ETPs), including Bitcoin ETP (BTCE), Ethereum with staking (ET32), Solana (ESOL), XRP (GXRP), and the MSCI Digital Assets Select 20 (DA20), according to an announcement on August 19. The firm has over $1 billion in assets under management.

Bitwise’s assets under administration have increased to over $4.5 billion due to the acquisition, which includes nine European-listed crypto ETPs.

Bitwise CEO Hunter Horsley stated, “This acquisition enables us to provide European investors with services, to provide clients with global insights, and to broaden the product suite with innovative ETPs.”

ETC Group has been introducing crypto ETPs since 2020 when it introduced its initial products on the Deutsche Börse Xetra with regulatory sanction from Germany’s Federal Financial Supervisory Authority—or BaFin.

The company is also responsible for a blockchain equity exchange-traded fund (ETF) that exposes investors to European blockchain-based enterprises.

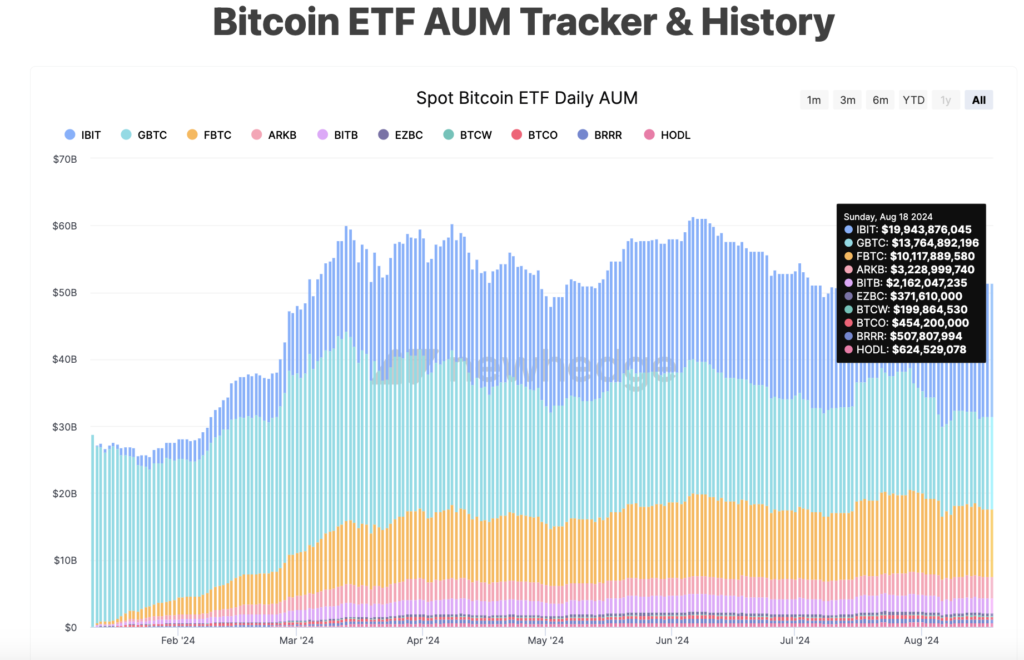

Bitwise is one of the asset administrators responsible for the recently approved spot bitcoin ETFs in the United States. The United States Securities and Exchange Commission approved 11 asset manager applications in January, including Bitwise’s Bitcoin ETF (BITB). As of August 19, the fund’s webpage indicates that it has nearly $2.27 billion in net assets.

In July, regulators permitted the company to introduce the Bitwise Ethereum ETF (ETHW), a spot Ether ETP. The fund has amassed over $300 million in assets within its initial weeks, as per Bitwise.

The adoption of crypto ETPs is anticipated to increase in the future years due to institutional demand and a maturing regulatory environment towards digital assets.

Horsley has previously characterized the adoption of Bitcoin ETFs by registered investment advisers (RIAs) and multifamily offices in the United States as “stealthy but significant.” Since the inception of 11 Bitcoin ETFs on Wall Street, they have amassed more than $51 billion in AUM.