The once-bullish sentiment for “Uptober” in the crypto market has faded as prices decline. Santiment reports a sharp drop in “Uptober” mentions, with traders now leaning towards terms like “Selltober” and “Octobear” amid growing pessimism.

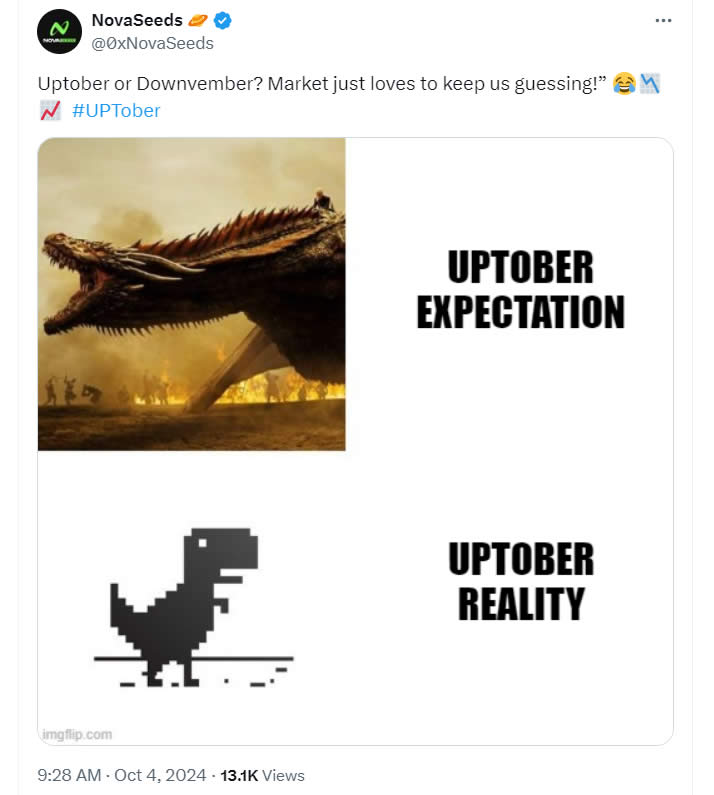

The bullish sentiment regarding cryptocurrency for the month of October, which has been labeled “Uptober” on social media, has been diminishing as markets continue to decline.

In an X post on Oct. 4, Santiment, a onchain analytics provider, observed a substantial decrease in the number of mentions of “Uptober” since the beginning of the month.

It was also stated that traders have become pessimistic about the notion that this month will serve as a “automatic money printer for crypto.” In contrast, social media has been inundated with parodies and references to “Selltober” and “Octobear.”

Nevertheless, Maksim Balashevich, the founder of Santiment, believes that the recent lack of optimism presents an opportunity for a temporary rebound.

“Uptober excitement wanes as the market dips, which does open the door for a rebound. Whether the bigger downtrend is over remains to be seen.”

Ash Crypto, a seasoned crypto trader, informed his 1.1 million X followers on October 3 that “BTC could drop a little more so that people will stop believing in Uptober.” He followed up with the following statement:

“Once bears start getting excited and calling for $40k to $45k, BTC will pump hard.”

In a note to investors on Oct. 4, 10x Research analysts stated that numerous crypto enthusiasts had been caught off guard since March, anticipating that the bull run would persist.

They stated that technical indicators indicated that the rally was overextended. However, they also noted that “it now appears that sell-offs from early adopters (OGs) and large token unlocks have been driving prices down” despite the strong inflows from stablecoins, Bitcoin Spot ETFs, and increased futures leverage.

Uptober isn’t usually on time

The crypto markets have experienced a decline of approximately $200 billion, or approximately 8%, since the begining of October. According to CoinGecko, the total capitalization has decreased by 1.9% as of Oct. 3, returning to the levels of $2.2 trillion that were observed in mid-September. On October 3, Bitcoin momentarily fell below $60,000 before recovering slightly to reclaim $61,000 at the time of publication.

However, October has been historically bullish for Bitcoin, as it has experienced positive price action in nine of the past eleven years. This is the reason it has earned its appellation.

Including bear market years, the past five consecutive Octobers have witnessed gains spanning from 5.5% to 40% over the month.

Nevertheless, if historical trends are any indication, markets typically experience an increase in the middle of October.

BTC experienced a 7% decline in the first half of October 2023, reaching a high of $28,500 on October 2 and subsequently declining to $26,650 by October 13. The asset subsequently experienced a nearly 30% increase, culminating in a monthly value of $34,500.