On October 7, CoinShares disclosed that crypto investment products experienced $147 million in outflows from September 29 to October 5 after inflows of nearly $2 billion in three previous weeks.

Crypto products achieved $1.2 billion in inflows in a single week from September 22 to September 28, following nearly $2 billion in inflows in the previous three weeks. Subsequently, outflows occurred.

CoinShares attributed the outflows from last week to stronger-than-anticipated economic data, which “decreased the likelihood of substantial rate cuts” soon.

According to James Butterfill, the director of research at CoinShares, trading volumes in ETP investment products increased by a marginal 15% for the week. In contrast, volumes in broader crypto markets have decreased.

Multi-coin products experience $29 million in inflows

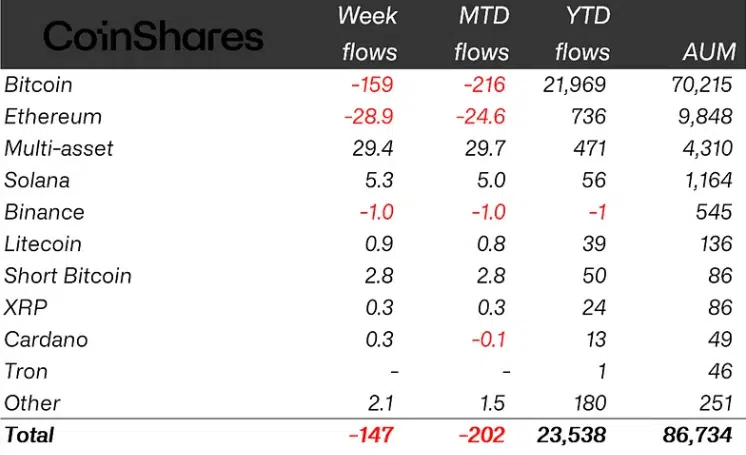

CoinShares reported that Bitcoin investment products were the most active trading products last week, with investors losing $159 million.

Since the introduction of ETH exchange-traded funds in the United States in July, products based on Ether, the second-largest cryptocurrency by market value, have experienced an ongoing negative trend, resulting in $28.9 million in outflows.

However, multi-asset investment products experienced inflows of $29 million last week, representing their 16th consecutive week of inflows.

Multi-asset products have accounted for $431 million in the past 16 weeks, which is 10% of the assets under management, according to CoinShares.

Investors who prefer to invest in a diversified basket of assets rather than individual ones have favored multi-asset products since June, according to Butterfill of CoinShares.

Canada has joined Switzerland in a favorable trend.

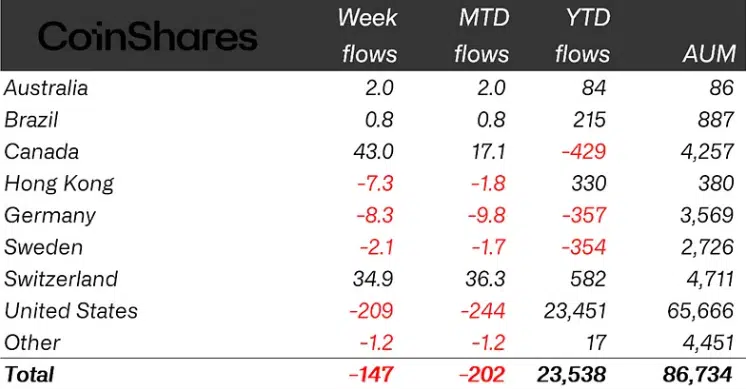

Although the United States was the source of outflows with a $209 million sell-off, specific countries, including Switzerland and Canada, experienced a favorable trend in crypto investment products last week.

As per CoinShares data, Switzerland and Canada experienced inflows of $35 million and $43 million, respectively, last week.

As of October 5, Switzerland is the second-largest investor in crypto products, with $538 million in year-to-date inflows.

According to CoinShares, the largest crypto investment products market, US-based products have received $23.4 billion in inflows thus far in 2024.

In 2024, Canada experienced nearly $430 million in outflows despite bullish activity last week.