Bitwise Asset Management acquired Attestant, a London-based Ethereum staking service, to expand beyond traditional crypto ETFs.

On Wednesday, Bitwise Asset Management, a cryptocurrency exchange-traded fund (ETF) provider, said that it had achieved the acquisition of Attestant, a service that provides Ethereum staking.

Given the company’s recent launch of several cryptocurrency-focused exchange-traded funds (ETFs), this acquisition coincides with the corporation’s plans to expand beyond its core industries. When this bull run is over, will the price of ETH reach a new all-time high?

Bitwise Deepens Crypto Push With Attestant’s Acquisition

At a time when the largest cryptocurrency fund manager is racing to launch a new exchange-traded fund (ETF) for a variety of cryptocurrencies, Bitwise Asset Management has purchased the Ethereum staking service Attestant.

Bloomberg published a report on November 13 that did not disclose the parameters of the cash and stock transaction. For its clients interested in exploring and earning yields through Ethereum staking, Attestant, based in London, manages assets worth $3.7 billion.

For this reason, they have also helped validate Ethereum blockchain transactions. A total of eleven individuals from Attestant will be joining Bitwise as a result of the acquisition. The cryptocurrency exchange-traded fund issuer will now manage net assets worth over ten billion dollars for its clients.

One in every five Bitwise customers has a desire to stake their cryptocurrency in order to generate yields from the process. On the other hand, the corporation believes that the majority of its customers will be interested in gambling investments during the next few years.

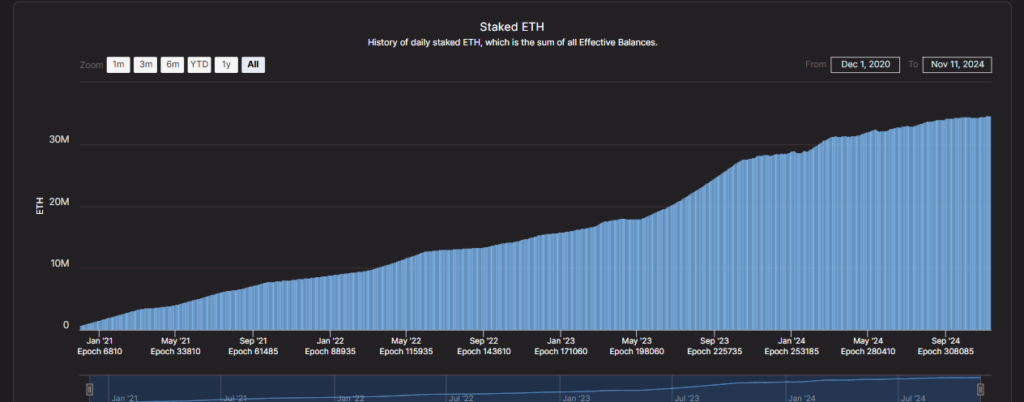

In an interview, Hunter Horsley, the Chief Executive Officer of Bitwise, claimed that Ethereum staking offers payouts of 3.78 percent. Additionally, investors have staked nearly one third of all Ethereum, representing a total value of $112 billion.

According to beaconcha.in’s data, investors have staked 34,566,523 ETH on the Beacon Chain. With around $3.8 billion in assets under management, Bitwise’s Bitcoin Exchange-Traded Fund (BITB) is the sixth largest of the dozen such funds that are available to investors in the United States.

The spot Bitcoin exchange-traded fund (ETF) has also seen a net inflow of $2.38 billion.On the other hand, the Bitwise Spot Ethereum ETF (ETHW) currently has assets under management worth 360.58 million dollars. The ETHW has received a total of $360.4 million in net inflows.

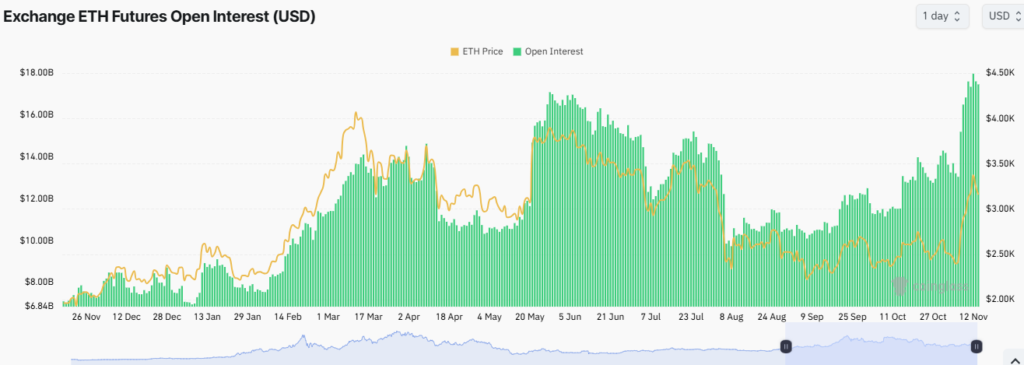

The ETHW received a total of seventeen million dollars on Tuesday.After the recent spike, the price of ETH has dropped by 6% in the previous twenty-four hours, and it is currently trading at $3,163. According to the 24-hour chart, the low price is $3,121, and the maximum price is $3,444.

In addition, the volume of trading has declined by ten percent over the course of the past twenty-four hours, which indicates a decrease in interest among traders. The total open interest in Ethereum futures has increased by 1% in the past four hours, while it has decreased by 4% in the past twenty-four hours. Currently, the value of the open interest in Bitcoin futures stands at $17.46 billion, indicating support for a further upward advance, despite its decline from its all-time