Aave Labs presented a proposal for the forthcoming iteration of its protocol, which encompassed enhancements to GHO, its stablecoin.

As part of a five-year road map, Aave Labs, the company responsible for the decentralized finance (DeFi) lending protocol Aave, has outlined a proposal to evolve and enhance its protocol.

The DeFi lending platform unveiled a governance proposal on May 1 to solicit community input regarding the upgrade of the protocol to version 4, the next iteration.

The team stated that the proposal also encompasses “major upgrades and expansions,” to the Aave Network, a cross-chain liquidity layer, layer-1 deployments of non-Ethereum Virtual Machines (EVMs), and a “novel visual identity.”

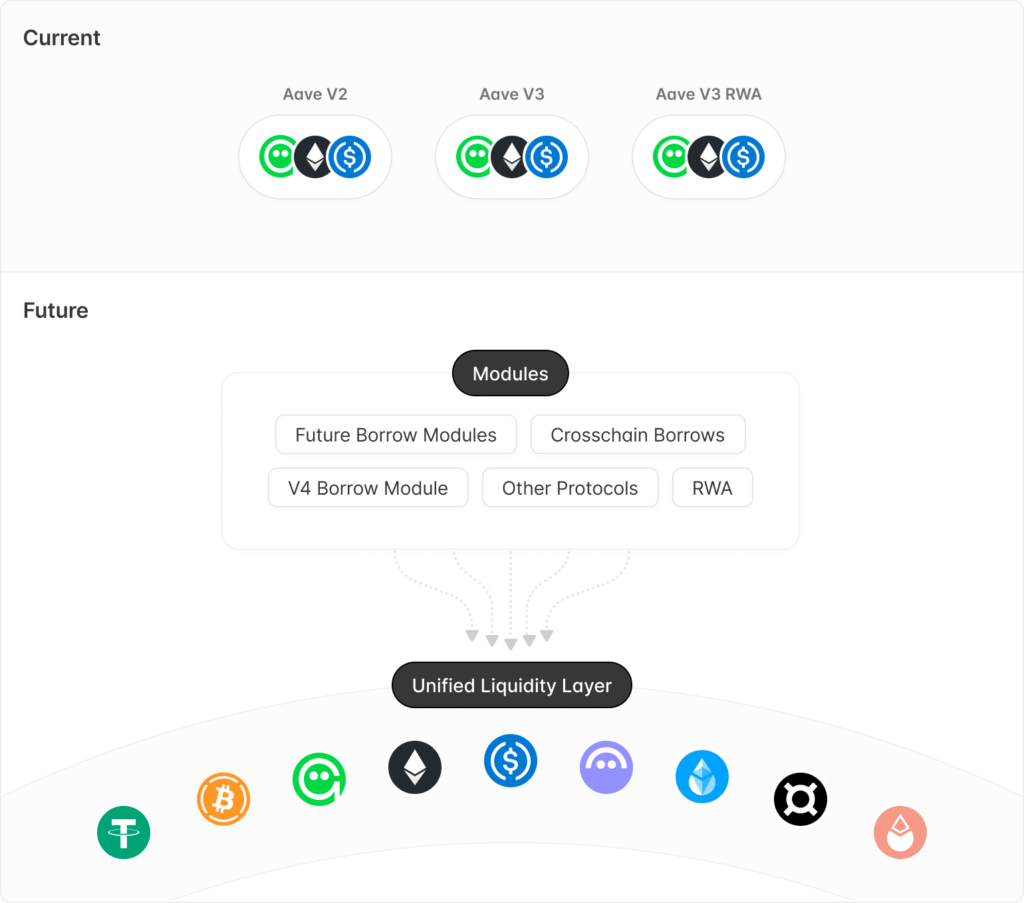

By incorporating a “Unified Liquidity Layer” and a “completely new architecture,” Aave V4 would facilitate the integration of risk modules, isolation pools, and its native stablecoin GHO.”

In addition, interest rates that can dynamically modify in response to market conditions and utilizing Chainlink data oracles are additional features that are being proposed.

Additionally, the implementation of smart accounts and liquidity premiums to tailor borrowing costs to collateral risk profiles and to simplify position management for users, vaults, and smart accounts was proposed.

A portion of the proposal centered on Aave’s algorithmic stablecoin GHO, which debuted in July 2023 but is relatively insignificant compared to rivals like Tether USDT. USDC and USD Coin had $49 million in market capitalization.

Suggestions about GHO include enhancements to the liquidation engine, including “soft” liquidations and variable liquidation incentives, and improved GHO integration, including interest-earning options.

An emergency redemption mechanism for GHO debugging scenarios was also suggested as part of the significant enhancement.

The proposal is undergoing a “temperature check” phase, which indicates community sentiment before an on-chain vote is conducted.

The document delineates a progression schedule from the research conclusion in the second quarter of 2024 to the complete release of V4 by the middle of 2025.

Aave Labs is seeking a grant of 15 million GHO and 25,000 stkAAVE, for a total value of approximately $17 million, to support the implementation of the initial year of the three-year strategy.

DefiLlama estimates that Aave is the third largest DeFi protocol in locked value, at approximately $10 billion. At the time of writing, its indigenous AAVE, the token was trading at $82.35 after losing 9% in value over the previous week. Three years after its all-time peak of $660, it has decreased by 87.6%.