In response to recent stablecoin price volatility, Aave has stopped trading stablecoins and set the loan-to-value (LTV) ratio to 0.

The trading halt, according to Aave’s governance forum, follows a report from decentralized financial risk management firm Gauntlet Network that suggests all v2 and v3 markets should be momentarily halted. One forum user made the following observation:

“Setting LTV to 0 definitely helps everywhere, but on the Avalanche v3 Pool, given that cross-chain infrastructure doesn’t cover Avalanche, the Aave Guardian can act immediately. Setting LTV to 0 in practise discounts the ‘borrowing power’ of the asset, without affecting the HF of any user position,”

LTV is a crucial number for figuring out how much credit you can get using cryptocurrency as security. The ratio is determined as a percentage by dividing the credit amount borrowed by the value of the security.

Gauntlet’s risk study looked at the amount of insolvencies that could happen in several scenarios, taking into account whether the price of USDC stabilizes, recovers, or dramatically declines:

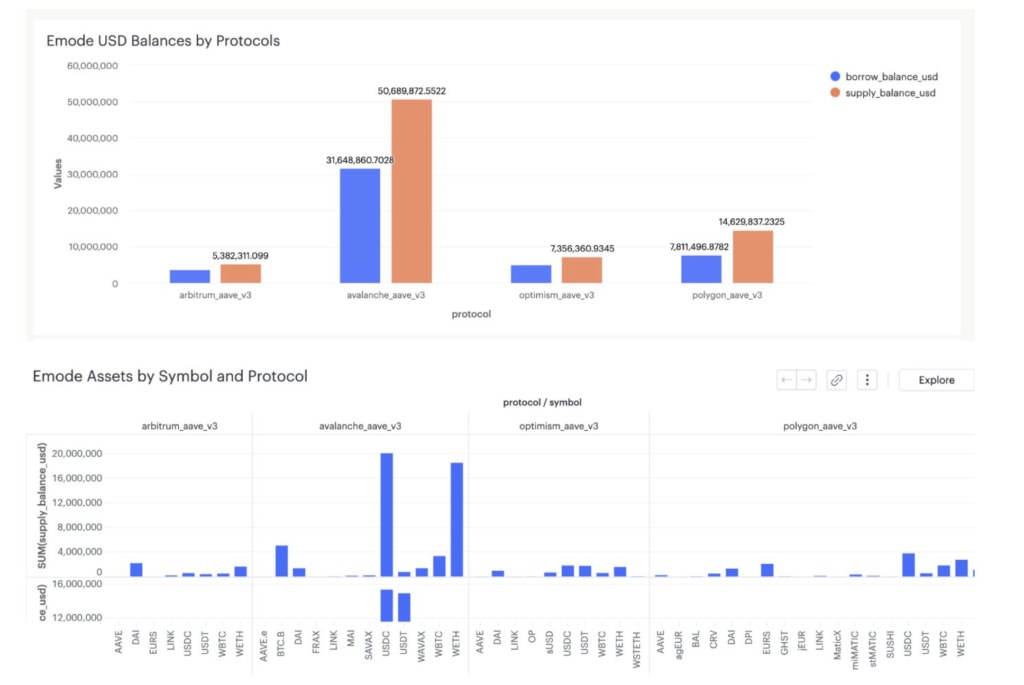

“V3 emode assumes correlation of stablecoin assets, but at this time, those correlations have diverged. The risk has increased given that the liquidation bonus is only 1% for USDC on emode. To account for these assumptions that no longer remain true, we recommend pausing the markets. […] At current prices, insolvencies are ~550k. These can change depending on the price trajectory and further depegs.”

According to digital assets analytics provider Kaiko, centralized crypto exchanges have observed a spike in trade volume in the hours following the failure of Silicon Valley Bank (SVB) on March 10.

After a bank run prompted by the bank’s most recent financial filings, which revealed it had sold a substantial portion of securities worth $21 billion at a loss of nearly $1.8 billion, SVB was shut down by the California Department of Financial Protection and Innovation on March 11.

The Federal Deposit Insurance Corporation was also named as the receiver by the California watchdog to safeguard insured deposits. The USDC’s creator, Circle, said on March 11 that $3.3 billion of its $40 billion in reserves was stranded at SBV, which caused its price to drop below its $1 peg and had an effect on other stablecoins.