Gauntlet, a crypto-focused financial modelling platform, has attained a unicorn status after obtaining $23.8 million in Series B funding from some of blockchain’s most prestigious venture capital firms.

According to Bloomberg, the financing round was led by Ribbit Capital, a Palo Alto-based venture capital firm, with existing backers Paradigm and Polychain Capital joining in. The money will be used to hire more people and grow into new industries, such as gaming, according to Gauntlet.

Tarun Chitra, a Wall Street executive who previously worked at multinational hedge fund D. E. Shaw, established Gauntlet in 2018. Gauntlet is a financial modelling and simulation company that focuses on capital efficiency and risk in the cryptocurrency business.

According to Crunchbase, Gauntlet secured its first seed investment of $2.9 million in 2018 from Coinbase Ventures and five other participants. Two years later, the company raised an additional $4.4 million.

Gauntlet’s $1 billion valuation underscores the cryptocurrency industry’s explosive rise over the last two years. Gauntlet’s core offering, according to Bloomberg, allows cryptocurrency projects specifically decentralized finance (DeFi) systems to undertake stress tests to assist them to determine the best lending and collateral levels.

Aave (AAVE) and Compound (COMP), two of Gauntlet’s most noteworthy clients, are two of the largest DeFi projects in terms of market capitalization and total value locked.

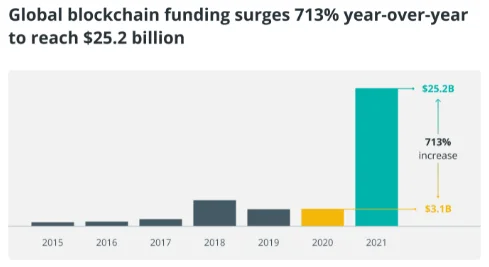

Since early 2021, companies in the crypto and blockchain industries have received significant venture funding, resulting in the crowning of numerous “unicorns.”

A unicorn is a startup with a valuation of at least $1 billion in the startup world. Over the last year, over a dozen unicorns have been crowned.

Last year, blockchain businesses raised $25.2 billion in venture capital, including 59 “mega-rounds” worth more than $100 million each, according to reports.