The proposal seeks to reduce risks with minimal user impact, given the small DAI collateral on Aave, and users can switch to USDC or USDT.

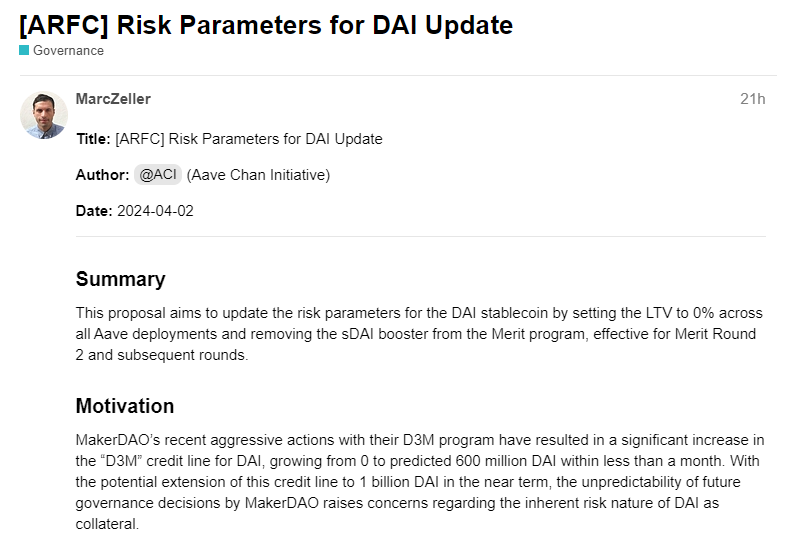

Lending procedure Aave has introduced a new proposal from the Aave Risk Framework Committee (ARFC) to modify the Dai stablecoin’s risk parameters.

The proposal was presented by the Aave Chan Initiative (ACI) team, which recommended that the loan-to-value ratio (LTV) of DAI be modified to 0% for all Aave deployments.

A portion of the proposal published on April 2 proposes the elimination of sDAI incentives from the Merit program, commencing with Merit Round 2 and moving forward.

This action aims to counter MakerDAO’s recent assertive D3M strategy, which expeditiously augmented the DAI credit line from zero to approximately 600 million DAI in a single month, with the potential for it to soon attain one billion DAI.

The proposal aims to mitigate potential risks with minimal user impact, considering that a small percentage of DAI deposits are utilized as collateral on Aave and users can transition to USD Coin USDC easily.

An instance of risky minting practices on a lesser scale is illustrated in the proposal, as in the case of Angle’s AgEUR (EURA), which was minted into EULER but was compromised within a week.

When used as loan collateral on AAVE, Angle, an overcollateralized stablecoin protocol, and AgEUR, a decentralized euro stablecoin, illustrate the risks of DAI’s stablecoin depegging.

Protocol for decentralized financing MakerDAO has initiated preparations for launching its much-anticipated “Endgame” transformation, which, according to co-founder Rune Christensen, will “orient the platform toward scalable resilience and sustainable user growth.”

Christensen declared the initiation of the “launch season” for the decentralized finance (DeFi) lending protocol in forum posts dated March 12, wherein he delineated a comprehensive five-phase strategy.

In the first phase, projected to commence in mid-2024, an external marketing firm will be retained to rebrand the operation as a more user-friendly and pleasurable concept.

Endgame’s ultimate objective is to increase the market capitalization of the protocol’s decentralized stablecoin, DAI, from its current $4.5 billion to “100 billion and beyond,” a level comparable to that of competitor Tether’s USDT.

Each Maker MKR will be renominated by MakerDAO. Twenty-four thousand NewGovTokens. In addition, non-U.S. residents who possess NewStable tokens can annually mine 600 million NewGovTokens.

According to DefiLlama, Eigenlayer surpassed lending titan Aave on March 6 to become the second-largest decentralized finance (DeFi) protocol with a total value locked (TVL) of $11.5 billion. Eigenlayer is now second only to Ethereum liquid staking protocol Lido.

Lido has fewer than 430 daily active users, whereas Aave has more than 5,700, according to data from Token Terminal.