In his 2025 budget proposal, United States President Joe Biden revived the notion of a 30% tax on electricity used by cryptocurrency miners. However, some crypto proponents do not see this move as good.

“General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals,” a document published by the U.S. Department of the Treasury, emphasized that existing legislation about digital assets is limited to reporting on currency and broker transactions.

In light of this, the administration intends to levy an excise tax on digital asset mining, similar to taxes imposed on fuel and other products. The Treasury expressed:

“Any firm using computing resources, whether owned by the firm or leased from others, to mine digital assets would be subject to an excise tax equal to 30 percent of the costs of electricity used in digital asset mining.”

Cryptocurrency mining companies must disclose the quantity and variety of electricity they consume, should the proposal materialize. Furthermore, organizations must disclose the cost of the electricity they consume when procuring it from external sources.

In the interim, miners engaging in computational capacity leasing would be required to reveal the utility value provided by the leasing company. Afterward, the value would function as the tax base.

Per the administration’s statement, this proposal would be effective for tax years after December 31, 2024. 10% in the first year, 20% in the second year, and 30% in the third year will comprise the tax’s introduction by the government.

Additionally, crypto mining companies that produce their electricity would be subject to the levy. Additionally, businesses that generate or obtain electricity “off-grid” would be subject to a 30% tax on the estimated cost of their electricity invoices.

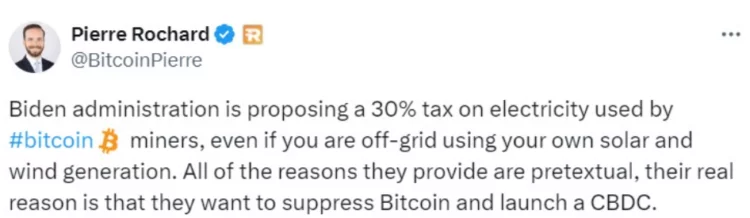

Vice president of research at Riot Platforms, a Bitcoin mining infrastructure provider, Pierre Rochard, emphasized that even those utilizing solar or wind energy would be impacted. According to Rochard, this is an attempt to stifle Bitcoin and introduce a central bank digital currency (CBDC).

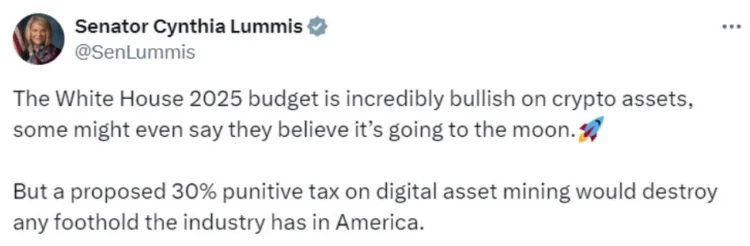

On X, in the interim, U.S. Senator Cynthia Lummis expressed her dissent towards the tax proposal. According to Lummis, a 30% tax would destroy the industry’s foothold in the United States. However, the administration’s inclusion of cryptocurrencies in the budget suggests it may be optimistic for the sector.

The Biden administration has previously attempted to impose a 30% tax on the electricity required by cryptocurrency miners. Biden tried to tax miners in the budget proposal 2024 on March 9, 2023.