The Fed is poised to announce its first interest rate cut since the pandemic, potentially causing further volatility before the next Bitcoin leg up.

Bitcoin’s price faces potential downside pressure ahead of tomorrow’s interest rate decision, following the loss of key support at $60,000.

Bitcoin volatility may lead to unpredictable price movements before the Federal Reserve’s (Fed) next interest rate decision on Sept. 18.

According to Bitfinex analysts, the decision could significantly affect Bitcoin’s price depending on the Fed’s move, as they explained to Cointelegraph:

“Depending on whether the rate cut is 25 basis points or 50 basis points, market behavior could swing between bullish optimism and cautious de-risking in response to major macroeconomic adjustments. This expected volatility might be reflected in flows across ETFs and perpetual markets, which are likely to exhibit increased fluctuations.”

The Fed is anticipated to announce its first interest rate cut since the start of the COVID-19 pandemic tomorrow.

Several analysts are predicting that Bitcoin could experience a breakout in October, potentially driven by the Fed’s rate cut.

Bitcoin Bottomed at $52,000: Bitfinex Analysts

On Sept. 14, Bitcoin briefly recovered above the $60,000 psychological threshold for the first time since Aug. 30 but quickly lost that support level again.

However, Bitfinex analysts suggest that Bitcoin’s recent price movements indicate the token may have found a bottom around $52,000. They elaborated:

“Our earlier view that Bitcoin’s dip to $52,756 on 6 September might represent a potential local bottom has been substantiated. Prices have subsequently increased by over 15 percent, supported by a significant uptick in Bitcoin ETF net inflows of $403.9 million over the past week.”

Bitfinex analysts had previously forecast a Bitcoin correction into the low $50,000 range, considering this a “critical point” for the market ahead of the upcoming interest rate cut.

Markets Expect a 50 Basis Point Rate Cut, but Analysts Disagree

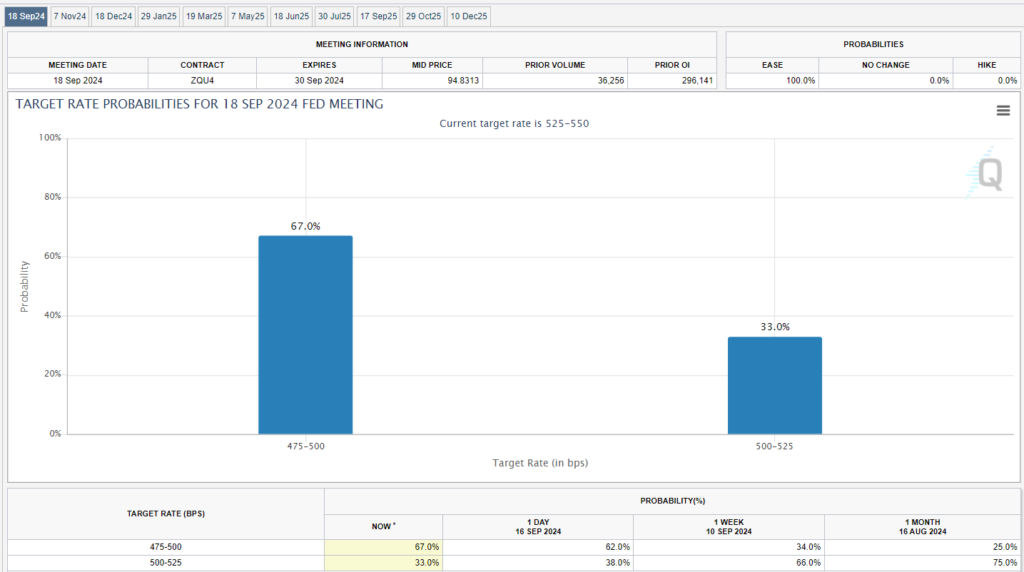

According to the latest data from the CME FedWatch tool, there is a 33% chance of a 25 basis-point rate cut, while the odds of a 50 basis-point cut stand at 67%.

Despite the growing expectation of a larger rate cut, Bitfinex analysts anticipate a 25 basis-point cut is more likely. They explained:

“There is slightly stronger core inflation, which we believe will make the Fed more cautious about rate cuts, and we expect a smaller 25 basis point cut, rather than a more aggressive 50 basis point reduction.”

The upcoming rate cut and historical chart patterns could set Bitcoin on a path for a three-month rally, potentially pushing its price above $92,000, given that October, November, and December have historically been bullish months for BTC.