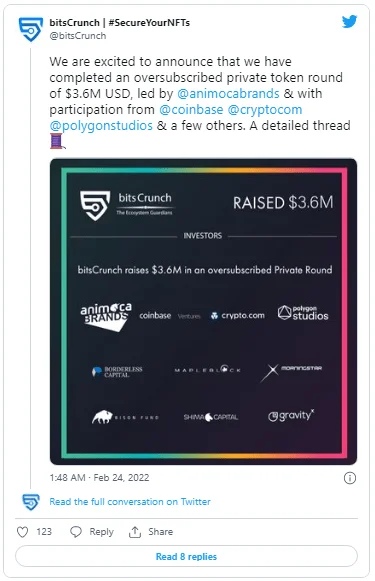

Animoca Brands, Coinbase Ventures, Crypto.com Capital, and a host of other venture firms have raised $3.6 million in a funding round for crypto and nonfungible token (NFT) analytics firm BitsCrunch.

To estimate the fair pricing of NFTs, discover wash trading warnings, and establish whether an NFT is a copy or forgery of the actual asset, BitsCrunch employs AI-based analytical techniques. The company’s headquarters are in Germany and India.

The firm believes that investors in the rapidly expanding industry require better data to safeguard them from imposters and being duped by phoney trade activity.

On February 25, BitsCrunch CEO Vijay Pravin Maharajan said that his company currently supports NFTs on Ethereum (ETH), Polygon (MATIC), and Avalanche (AVAX), but that he plans to use the funds “to expand the team that can focus on securing many prominent blockchains like Solana (SOL), Polkadot (DOT), Algorand (ALGO), and others.”

In a tweet on Feb. 24, the company expressed its expectation that the new features will make the “whole ecosystem more trustworthy & safe for the community.”

Fundraising for crypto businesses

The round’s primary investor, Animoca Brands, has been one of the most active VC firms in the NFT market. Due to the magnitude of profit in its investment portfolio, which includes Axie Infinity, The Sandbox, and many other NFT-based initiatives, it was valued at $5 billion last month.

In a Feb. 25 statement, Animoca co-founder Yat Siu claimed that BitsCrunch is in an excellent position to assist investors in making informed investment decisions. He went on to say that it can “contribute meaningfully to the growing open metaverse’s safety and security.”

The amount of money raised for NFT initiatives in the last 30 days demonstrates that the desire for advancement in the industry is still high. Since Jan. 25, at least 27 other NFT projects have raised a total of $251 million, according to cryptocurrency fundraising tracker Airtable.

Despite lower trading volume on the all-time leading NFT platform, OpenSea, interest in the asset class has not waned. Because of its reduced fees and higher rewards for investors, much of the trade volume for Ethereum’s most popular asset other than ETH appears to have transferred from OpenSea to the LooksRare marketplace.