Cathie Wood’s ARK Invest has resumed active trading of crypto-related stocks, selling $14.6M in Coinbase shares and buying $21M of 3iQ Ether staking ETF.

According to trading data obtained by Cointelegraph, ARK increased COIN selling in August 2024, unloading 69,069 COIN shares on August 1, following the resumption of substantial Coinbase (COIN) sales in July.

According to data from TradingView, the quantity is valued at $14.7 million based on the stock’s close price.

The transaction represents the largest Coinbase sale for ARK since early April and late March when the company sold approximately 60,000 COIN shares daily.

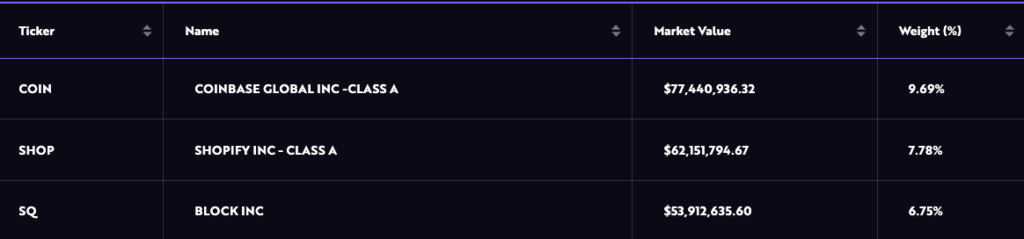

ARK’s funds continue to possess a substantial proportion of Coinbase shares despite the resumption of significant Coinbase sales. Coinbase is the most valuable asset in the ARK Fintech Innovation ETF (ARKF) as of August 2, comprising nearly 10% of the fund’s portfolio.

Coinbase reported $1.4 billion in total revenue in the second quarter of 2024, which coincided with ARK’s substantial Coinbase sales.

Tom Duff Gordon, Coinbase’s vice president of international policy, stated, “The performance observed during this quarter indicates the remarkable strides we have made as a company in our efforts to promote regulatory clarity on a global scale.”

ARK purchases 3iQ Ether staking ETF

ARK has made its initial purchase of the Canadian 3iQ Ether staking ETF (ETHQ.U) while dumping Coinbase.

This fund actively pursues long-term capital appreciation by investing in Ether and generating passive rewards through staking.

3iQ expanded the product with staking in 2023 in collaboration with Coinbase and Tetra Trust after launching the fund as the 3iQ Ether ETF in 2021.

TradingView data indicates that ARK acquired 1.7 million ETHQ.U shares on August 1, totaling $21 million, as indicated by its trading data—approximately one million ETHQ.

The ARK Next Generation Internet ETF (ARKW) allotted U shares from this amount, while the ARK Fintech Innovation ETF purchased the remaining 651,713 shares.

The 3iQ Ether staking ETF, which closed at $12.3 on August 1, has experienced substantial growth in recent months, with a year-to-date increase of approximately 40%.

ARK Invest Sells its Robinhood Shares, Bitcoin ETF

ARK has also sold shares from its Robinhood (HOOD) cache and its spot Bitcoin ETF, the ARK Invest, and 21Shares (ARKB), in addition to selling the Coinbase stock. On January 11, 2024, ARK’s spot Bitcoin ETF debuted trading in the United States, in addition to nine other spot Bitcoin ETFs.

TradingView data shows Cathie Wood’s investment firm liquidated 108,751 ARKB shares from its ARKW fund on August 1, resulting in approximately $6.9 million. Additionally, ARK sold 282,435 Robinhood shares for $5.7 million.