RedStone Oracles has raised $15 million in Series A funding for its modular blockchain oracle solution, led by Arrington Capital.

RedStone, which identifies itself as the “fastest-growing modular oracle,” intends to leverage the recently obtained funds to extend the reach of its oracle products. These products offer gas fee-optimized price feeds for all Ethereum Virtual Machine (EVM) and rollup-as-a-service (RaaS) networks.

Arrington Capital spearheaded the funding round, including prominent investment firms Spartan, IOSG Ventures, SevenX, Amber, HTX Ventures, and angel investors, including the founders of EtherFi and Berachain.

Michael Arrington, the founder of Arrington Capital, stated that the sophisticated infrastructure of RedStone’s solution was the key factor in his decision to invest in it.

“We have been impressed by RedStone’s ability to push ahead web3 infrastructure in technical achievement, go-to-market, and security. This is a team of builders who we believe will continue to lead in the oracle space.”

RedStone’s Oracles can Help DApps Efficacy

Founded in 2021 during the Arweave incubation program, RedStone has garnered substantial momentum since the introduction of its mainnet in January 2023. It has secured $4 billion in value and accumulated over 100 clients.

The chain-agnostic solution is an excellent choice for projects developing on emerging networks such as zkSync Era, Linea, Mantle, and Scroll, as it supports over 60 blockchains.

RedStone aims to provide lower transaction costs (gas fees) than other Oracle solutions, which can assist decentralized applications (DApps) in reducing redundant data and price feed-related overhead costs.

RedStone prevents the imposition of excessive gas fees by refraining from transmitting the same data to multiple chains.

Blockchain Oracles Exceeds $13B

Blockchain oracles are a rapidly expanding decentralized finance (DeFi) industry sector.

CoinMarketCap data indicates that the aggregate market capitalization of all oracle-related cryptocurrencies was $13.1 billion on June 3.

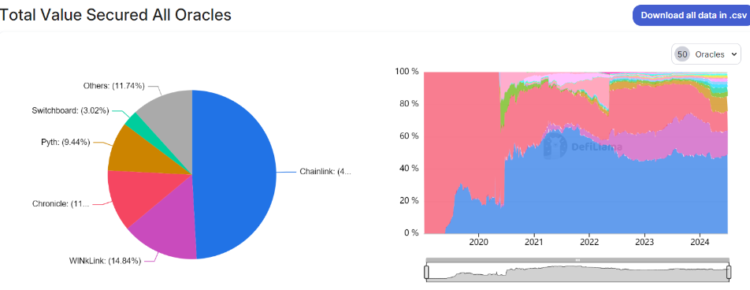

According to DefiLlama data, Chainlink is the most significant oracle solution, with a total value secured (TVS) of over $24.3 billion across nearly 400 protocols. WinkLink is the second largest oracle solution, with a TVS of $7.35 billion across two protocols.

DefiLlama currently monitors RedStone as the sixth-largest oracle solution, with a $1.32 billion TVS across 38 protocols.