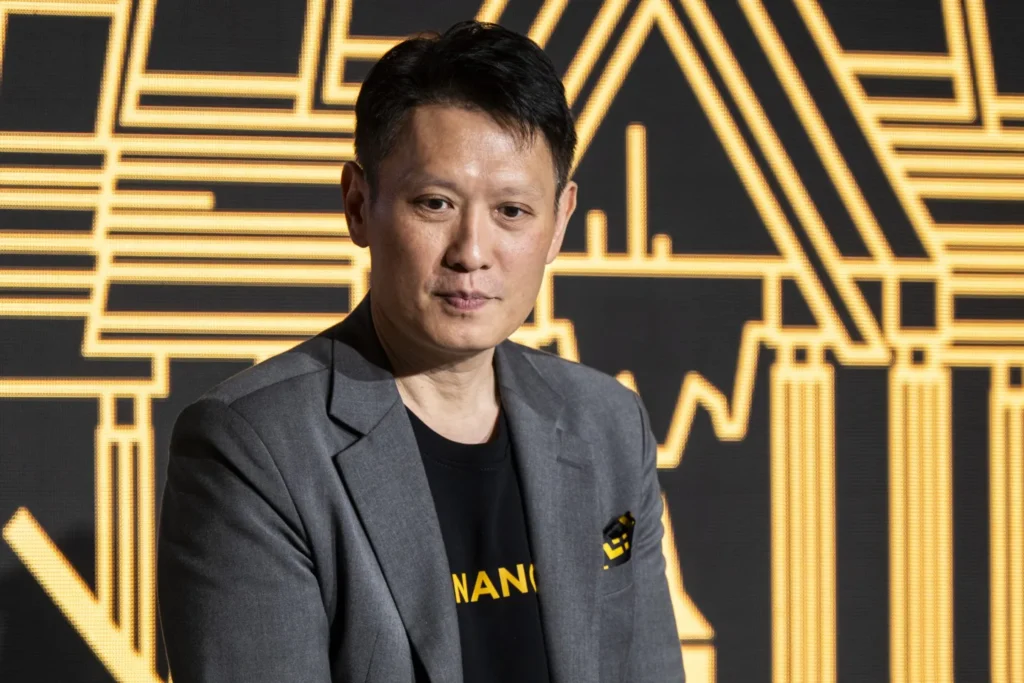

Binance CEO Richard Teng announced that the crypto exchange’s institutional and corporate investors increased by 40% this year.

Binance CEO Richard Teng has announced that the exchange’s institutional and corporate investors have grown by 40% this year, underlining institutions’ increasing exposure to crypto assets, particularly following the launch of spot Bitcoin and Ethereum ETFs.

Despite this growth, Teng believes that institutional adoption of crypto is just beginning.

Binance CEO Reports 40% Growth in Institutional Investment

During an interview at the Token2049 conference in Singapore, Teng shared that Binance experienced a 40% rise in institutional and corporate investors in 2024.

However, he emphasized that this level of institutional allocation is “just the tip of the iceberg” and expects further growth as more institutions begin investing in crypto assets.

Teng added that many institutions are still conducting due diligence, which has slowed their entry into the crypto market.

He expressed confidence that greater regulatory clarity would provide the certainty needed to attract more institutions and mainstream users, ultimately increasing liquidity in the crypto space.

He also highlighted the impact of institutional investment on Bitcoin’s performance, attributing Bitcoin’s all-time high (ATH) of $73,000 in March to institutional inflows.

The approval of Spot Bitcoin ETFs in January triggered a surge of institutional money into the BTC ecosystem, contributing to the parabolic price rally.

Spot Bitcoin ETFs Still Have Room for Growth

Nate Geraci, President of the ETF Store, echoed Teng’s views, stating that Spot Bitcoin ETFs have not yet reached their full potential.

SoSoValue data indicates that since their launch, Bitcoin ETFs have seen net inflows of $17.44 billion.

BlackRock and Fidelity, two of the most successful ETF issuers, currently manage over $21 billion and $10 billion in assets, respectively.

However, Geraci believes there is still more room for growth, pointing out that many major brokerage firms, or “wirehouses,” have yet to approve these Bitcoin ETFs. Like Teng, Geraci expects more institutional investors to allocate resources to crypto over time.

Additionally, other crypto ETFs, aside from Spot Bitcoin and Ethereum ETFs, may soon emerge.

Asset managers VanEck and 21 Shares have already filed for a Spot Solana ETF, while Grayscale has introduced its Grayscale XRP Trust, which could eventually become a Spot XRP ETF.