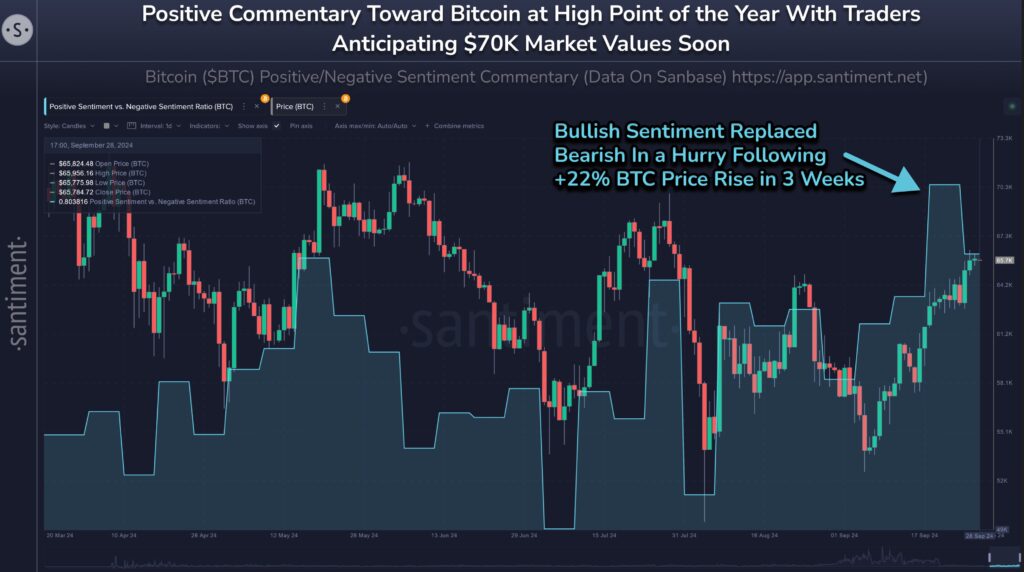

As of September 30, Santiment noted 1.8 bullish Bitcoin posts for every negative one, indicating a shift to optimism.

According to Santment, the cryptocurrency market sentiment is at its highest level in months, which means that it is unlikely that Bitcoin will achieve an all-time high anytime soon.

The blockchain analytics platform Santiment suggested in a statement on September 30th that those expecting a new all-time high for Bitcoin might have to wait until the community “slows down their own expectations”.

An analysis of social mood data revealed that there are currently 1.8 bullish posts about Bitcoin for every negative one. Over the course of the previous two weeks, sentiment has become exceedingly optimistic, with Bitcoin values steadily gaining almost 14% from below $58,000 on September 17 to reaching a high of nearly $66,000 on September 28.

When it comes to gains, BTC is on course to post its best-ever September. Up to this point, the gains have been approximately 12%. Jameson Lopp, the chief security officer for Casa, observed that mainstream media organizations were also moving into more positive areas.

In a post that he made on X on September 29th, he stated that “FUD fails to withstand the test of time,” which caused the mood around BTC to turn in a positive direction in mainstream media. On September 30, the Bitcoin Fear and Greed Index, which is also a measure of market mood, returned to greed levels with a rating of 61.

This indicates that market sentiment has returned to normal levels. A few weeks ago, the index reached a level of “extreme fear” when it dropped to 22 on September 6th, which was one of its lowest levels all throughout the previous year

.On September 29, bearish demand for stablecoins in China could potentially postpone Bitcoin’s ATH. Bearish sentiment is evident when dollar-linked stablecoins in China trade at a discount instead of a premium.

According to CoinGecko, the current price of bitcoin is $64,406, which is around 12.6% lower than its all-time high of $73,734 in March. Additionally, the asset experienced a significant decline during early trading on September 30. The asset experienced a decline of approximately two percent in the six hours before the writing of this article.