PlanB said the price tank suffered by Bitcoin is in correlation with the U.S. equities market.

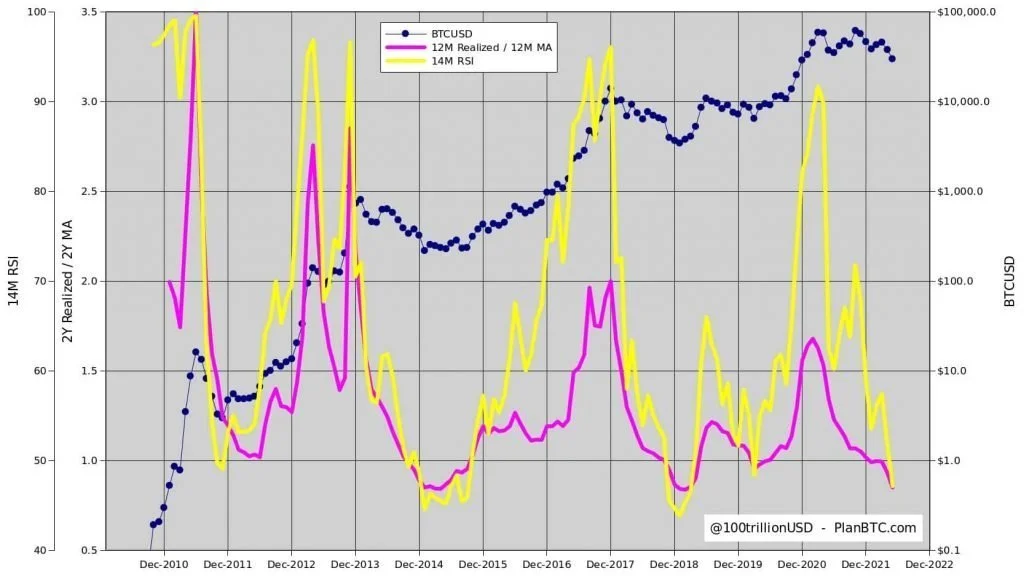

PlanB, the creator of the stock-to-flow (S2F) model, believes the bear market is nearly over. He is upbeat because periods with the Realized Price Moving Average (RPMA) 1 and the Relative Strength Index (RSI) 50 have historically been excellent times to buy. PlanB, on the other hand, believes it will take some time for the RPMA and RSI to rise again.

PlanB recently revealed that the price of Bitcoin (BTC) is forming a new bottom for the next bull market. This week’s BTC trend followed PlanB forecasts, with the price reaching a low near $28,500.

Now, PlanB reports in a tweet that the bear market is almost over and that prices should begin to rise again. He believes that the current levels of the RPMA and RSI indicate that Bitcoin has reached a bottom. However, a bounce could take 6-9 months (as in 2014 and 2018/19) or 1-2 months (as in 2011 and 2020). Bitcoin is currently trading sideways near the $30,000 mark.

“Realized Price / Moving Average (RPMA, purple) shows the Bitcoin cycle best. Relative Strength Index (RSI, yellow) is similar but can be misleading at critical times (e.g. 2nd half of 2021). The good news: the bear market is almost over. Waiting for RPMA and RSI to start rising again.”

PlanB also shared a correlation between the US equity market and Bitcoin, specifically the S&P 500 and Bitcoin. Since November 2021, both the stock market and Bitcoin have declined.

Meanwhile, the S&P 500 is in a bear market, having fallen nearly 20%. Long-term investors, according to analysts, may benefit from Bitcoin accumulation at the current price.

Regardless of PlanB’s stance on the bear market, his followers believe it is far from over, given Bitcoin’s halving. The trend indicates that the b

Bitcoin price will likely rebound in October. However, if the 2Y realized price and RSI form a v-shape recovery, the bear market will end in 1-2 months. In a year, a new all-time high could be set.