Robert Kiyosaki, an ardent proponent of Bitcoin, drew attention to the role that American leaders play in the nation’s economic imbalance.

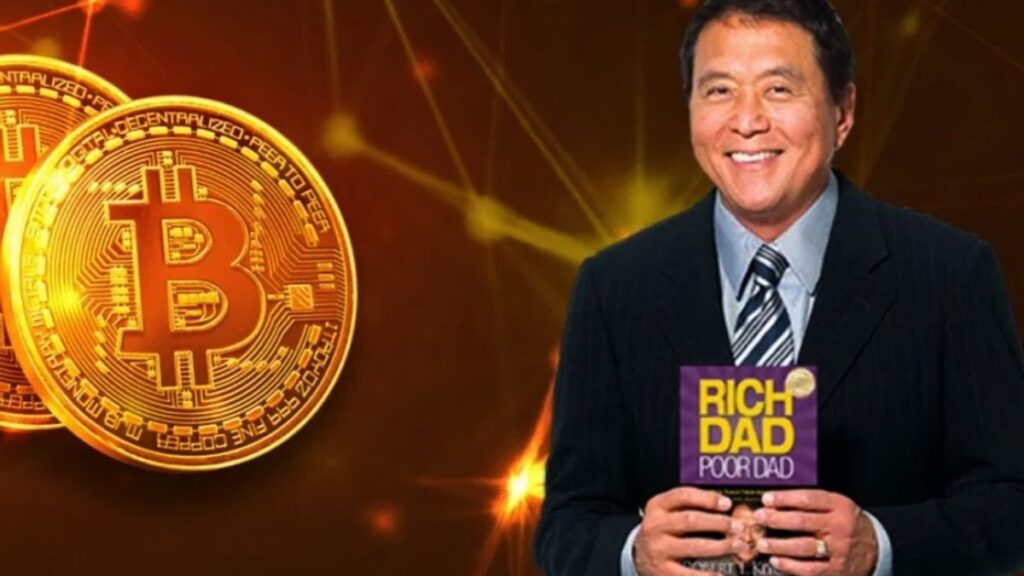

Robert Kiyosaki, a well-known financial educator and author of “Rich Dad Poor Dad,” recently offered a comprehensive analysis regarding his audacious forecast that the price of Bitcoin (BTC) would escalate to $300,000. Kiyosaki’s prognosis is based on an exhaustive examination of worldwide economic patterns and the intrinsic value proposition of Bitcoin.

Therefore, it provides investors with invaluable guidance as they navigate the ambiguous financial landscape amidst inflation and other monetary concerns.

As a hedge, Robert Kiyosaki endorses Bitcoin. Kiyosaki placed significant emphasis on the context of escalating economic turmoil, which was marked by currency devaluation, skyrocketing debt levels, and geopolitical tensions.

Furthermore, the Bitcoin advocate reaffirmed his enduring admonition against conventional fiat currencies, characterizing them as “fake money.”

Conversely, he espoused using Bitcoin as a decentralized safeguard against the drawbacks inherent in centralized monetary systems. Furthermore, he emphasized the significance of Bitcoin’s network strength, making analogies to Metcalfe’s Law and highlighting the resiliency of BTC.

As a reaction to apprehensions regarding the capriciousness and volatility of Bitcoin, Kiyosaki advised investors to distinguish between the potential of Bitcoin and the intrinsic perils associated with fiat currencies. He reiterated the recommendation to include tangible assets such as gold, silver, and Bitcoin in diversified portfolios.

In response to skepticism regarding the legitimacy of Bitcoin, Kiyosaki contested the notion that conventional fiat currencies are impervious to fraud. Moreover, he likened fiat to “colossal Ponzi schemes.” Furthermore, he observed that Bitcoin experiences fluctuations, presenting a potential avenue for recuperation.

However, he noted that a recovery would be nearly impossible if the US Dollar crashed like a meme coin. Furthermore, he emphasized that the United States is “broke” due to its debt trap, which requires the government to print $1 trillion daily to pay its expenses. This observation implies the possibility of devaluation due to the absence of scarcity.

The Bitcoin advocate further criticized the political leaders of the United States. Kiyosaki stated in a post on X, “They are either corrupt or incompetent, or both. Our leaders are bewildered as to how to rein in the escalating US government debt and bond market and the inflated stock market.” He believes that those responsible for robbing people around the world “should resign, be fired, impeached, or put in jail.”

Kiyosaki Rallies BTC Purchase Campaign

Kiyosaki’s optimistic perspective is predicated on the forthcoming Halving event of Bitcoin, colloquially known as “the Halvening.” Following this occurrence, the Bitcoin mining rate diminishes by half every four years. Probable to transpire in April 2024, this Halving is expected to augment the scarcity of Bitcoin, a significant catalyst for its appreciation in value.

Kiyosaki emphasized the historical importance of prior halving events as catalysts for considerable price rallies. Furthermore, he emphasized the possibility that Bitcoin could experience an unparalleled surge in value following the forthcoming Halving.

Given his sanguine perspective, Kiyosaki revealed his intention to augment his Bitcoin reserves by acquiring an extra 10 BTC before April. The speaker emphasized the significance of leveraging the prospective positive aspects of Bitcoin and endorsed robust investment approaches that place a premium on obtaining physical assets that possess inherent worth.

Kiyosaki anticipated that the price of Bitcoin would attain $100,000 by September 2024. The individual referenced many elements, encompassing heightened institutional adoption, expanding mainstream acceptability, and waning confidence in conventional financial systems.

Although Kiyosaki recognized the intrinsic volatility of Bitcoin, he advised investors to embrace a long-term outlook and perceive price fluctuations as prospects rather than impediments.

Furthermore, Kiyosaki partnered with prominent individuals in the cryptocurrency industry, such as Andy Schectman, a precious metals expert, and MicroStrategy CEO Michael Saylor, to underscore portfolio diversification’s importance. They advocated mitigating financial crises through gold, silver, and Bitcoin investments.