Despite declining inflows, Bitcoin ETF trading activity in March exceeded that of February, indicating sustained market engagement.

The Bitcoin ETF experienced a period of positive inflows during the last week, totaling $485 million.

However, the rate of BTC ETF inflows has decelerated, prompting numerous individuals to speculate on whether this will impede Bitcoin’s ascent to $100,000.

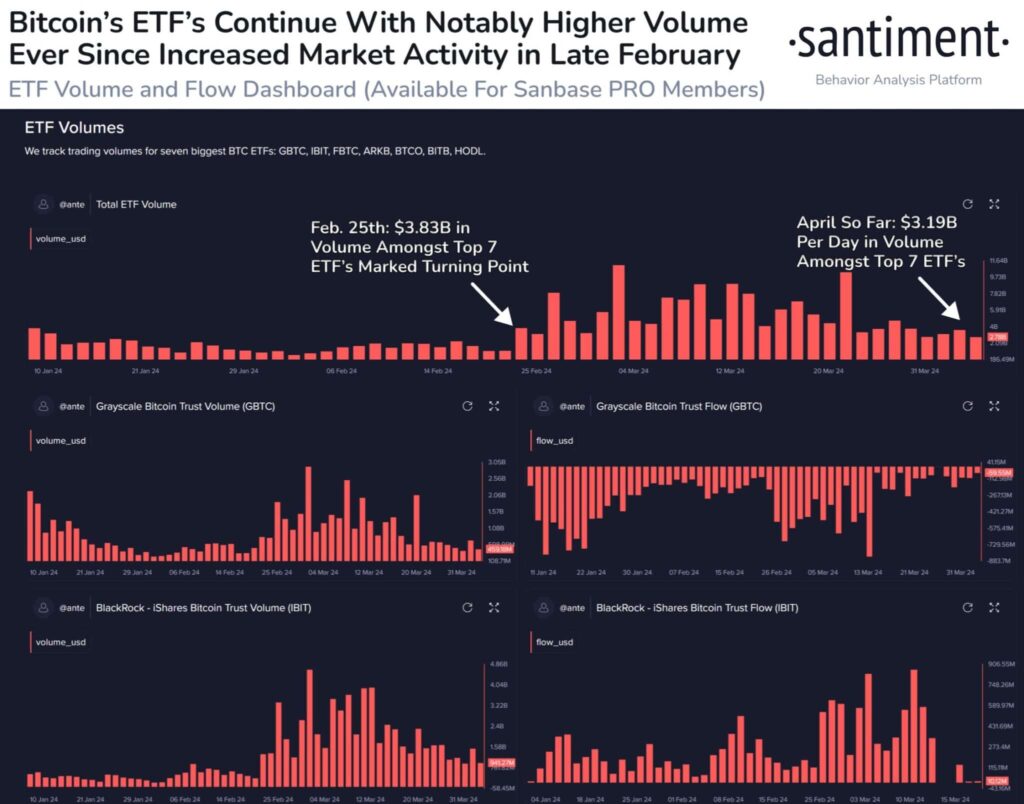

Bitcoin ETF Volumes Remain High

Despite the Bitcoin price decline from its peak to a level below $70,000, Bitcoin ETF trading volumes remain high.

According to Santiment, an on-chain data provider, trading volume has remained strong even four weeks after Bitcoin’s all-time high.

Trader activity on multiple platforms, including GBTC, IBIT, FBTC, ARKB, BTCO, BITB, and HODL, has consistently surpassed levels observed since late February.

This suggests that market engagement has remained robust since that time.

Given the impending halving event on April 19th, there is considerable consensus that this increased level of activity will endure.

However, speculation exists concerning the possibility of a decrease in the volume of exchange-traded funds (ETFs) and on-chain transactions immediately after the halving, which has generated curiosity in the analysis of market dynamics after the halving.

BTC Price Action Ahead

The ongoing demand for BTC-spot ETFs is a positive indicator for BTC, especially as the Bitcoin halving event approaches in the next 10 days.

Meanwhile, the impending supply cut, along with ongoing demand from the BTC-spot ETF market, might push BTC values above $80,000.

However, the Federal Reserve’s monetary policy continues to exert a substantial impact on the BTC-spot ETF market dynamics.

Potential interest rate modifications by the Federal Reserve may prompt fluctuations in US economic indicators to affect the demand for Bitcoin.

The market anticipates that the publication of US inflation data this week will impact expectations regarding the Federal Reserve’s potential interest rate adjustment in June.

BTC maintained a comfortable distance above the 50-day and 200-day moving averages, validating favorable price indicators.

A Bitcoin advance exceeding $70,000 may generate favorable momentum and potentially confront the prior all-time high (ATH) of $73,808 attained on March 14.

Meanwhile, a breach of the ATH could cause the bulls to shift their focus towards the $75,000 level.

It is advisable for market participants to diligently observe the market flow data of BTC-spot ETFs, US economic indicators, and Federal Reserve statements on Monday.

Conversely, a decrease in Bitcoin’s value below the $69,000 support level could signify an impending decline towards the $64,000 level.