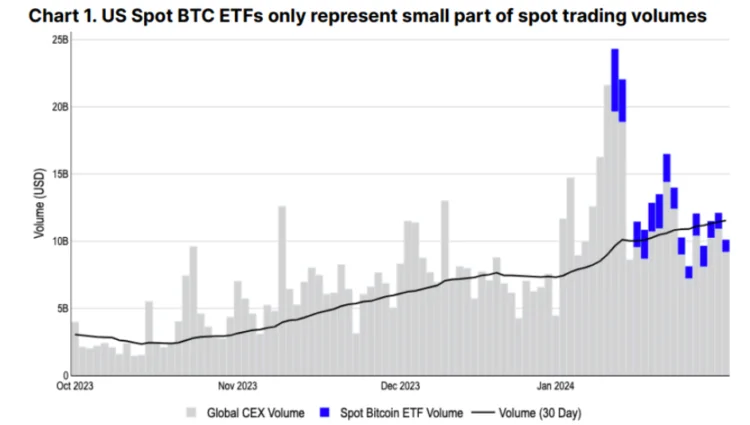

U.S. spot Bitcoin ETFs now account for “only 10-15%” of the total Bitcoin spot trading volume across centralized exchanges (CEX) worldwide and possess approximately 650,000 BTC or 3% of the outstanding Bitcoin supply.

Short-term attention towards spot Bitcoin exchange-traded funds (ETFs) could potentially divert attention away from the more significant crypto trends emerging in the aftermath of ETFs, according to David Duong and David Han, analysts at Coinbase.

Analysts note in the February 8 publication of the Coinbase “Monthly Outlook: Post-ETF Trading Themes” report that the performance impact of the $1.46 billion inflow into spot Bitcoin ETFs in January was “short-term overestimated.”

The authors of the study stated that U.S. spot Bitcoin ETFs now account for “only 10-15%” of the total Bitcoin spot trading volume across centralized exchanges (CEX) worldwide, despite the launch of spot Bitcoin ETFs being a “watershed moment for the crypto economy.” The report stated that spot Bitcoin ETFs possess approximately 650,000 BTC or 3% of the outstanding Bitcoin supply.

Based on data provided by CoinMarketCap, the spot trading volume of Bitcoin during the preceding twenty-four hours as of publication was $29.5 billion. According to public trading data, as of February 8, ten spot Bitcoin ETFs reportedly exchanged for approximately $1.3 billion, or 4.4% of the Bitcoin traded on CEXs in the previous twenty-four hours.

Following the spot Bitcoin ETF launches in the United States, more significant crypto themes have emerged, according to Coinbase analysts. One such theme is the increasing decentralized financing (DeFi) activity, which could “substantially” enhance Ether’s value proposition.

In addition to DeFi growth and selling pressure on Bitcoin miners as the halving approaches, analysts identify ETH strength as one of three key themes in the industry, given that 58% of the total DeFi value remains secured on the Ethereum blockchain.

“We believe the April halving of Bitcoin could hurt the economics surrounding mining, potentially increasing the selling pressure on miners as profit margins contract and Bitcoin can retain less excess profit,” the study states, adding that miner selling may not have an immediate effect.

Activity has decreased significantly over the past few years, as previously reported by Cointelegraph, since October 2021, when the total value locked (TVL) in DeFi surpassed $200 billion.

According to DefiLlama data, the DeFi TVL has been on the rise thus far in 2024, increasing by 18% from $55 billion on January 1 to $65 billion at the time of writing.

According to data from CoinGecko, the price of ETH has increased substantially year-to-date, rising 7% from $2,350 on January 1 to $2,510 at the time of writing.

Ryan Berckmans, an investor and member of the Ethereum community, believes that the transition of Ethereum’s consensus mechanism from proof-of-work to proof-of-stake could propel the price of ETH to as high as $27,000 during the bull cycle.