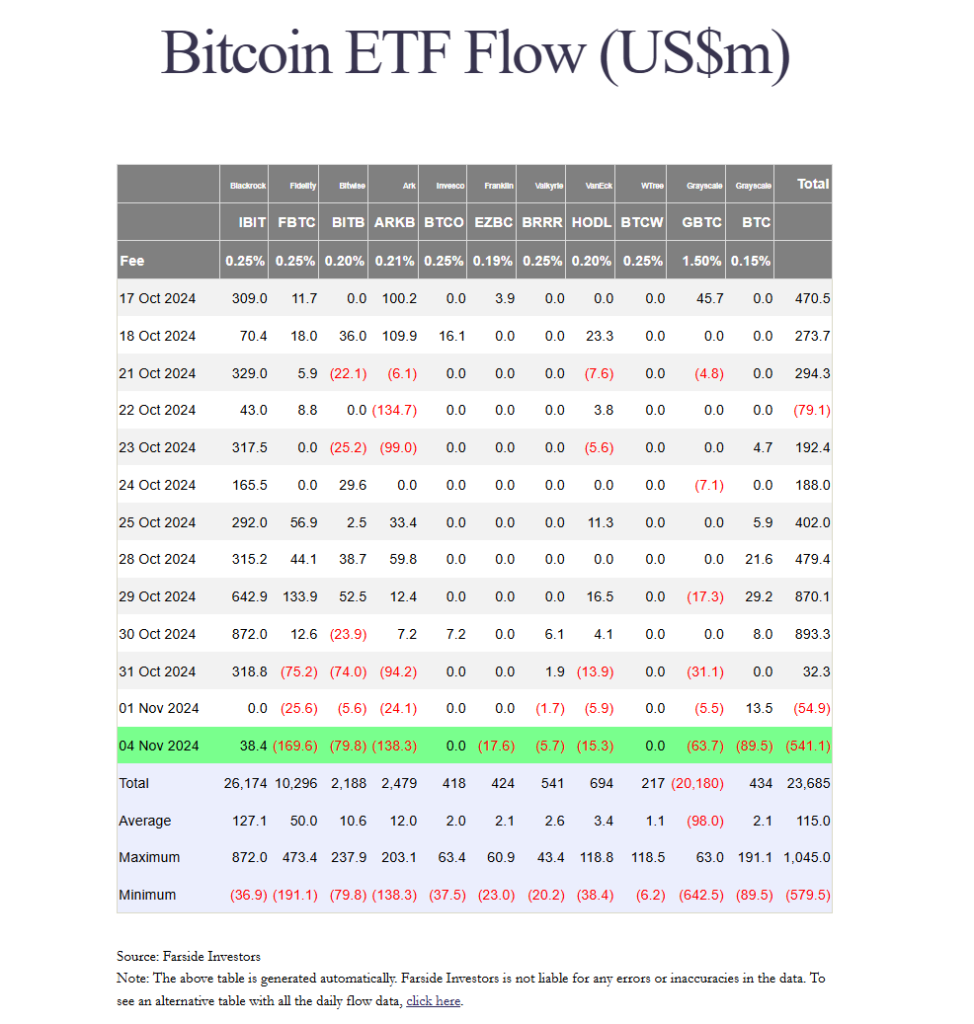

Bitcoin ETFs recorded $541 million in outflows, led by Fidelity’s FBTC with $170 million in withdrawals. While most ETFs saw losses, BlackRock’s IBIT reported $38 million in inflows amid Bitcoin’s recent price dip below $70,000.

Investors withdrew $541 million from US spot Bitcoin ETFs on November 4, the second-largest single-day outflow since their inception, according to data from Farside Investors.

Fidelity’s FBTC experienced the heaviest withdrawals on Monday, with $170 million, its second-largest daily discharge. This selloff just trailed behind the record of $563 million set on May 1.

Ark Invest’s ARKB and Bitwise’s BITB experienced their most dismal performances since their inception, with outflows of $138 million and $80 million, respectively. Grayscale’s BTC experienced $89 million in withdrawals, while its GBTC fund experienced a $64 million loss.

Franklin Templeton, VanEck, and Valkyrie funds collectively experienced outflows that exceeded $38 million.

In contrast, BlackRock’s IBIT reported approximately $38 million in net inflows, while WisdomTree’s BTCW and Invesco’s BTCO did not disclose any flows.

Last Friday, the seven-day winning sequence of Spot Bitcoin ETFs was terminated as Bitcoin plummeted below $70,000 after trading near its all-time high earlier in the week, according to CoinGecko.

Over the weekend, the largest crypto asset declined, reaching a low of $67,300. Furthermore, it has maintained its gains since the US Federal Reserve implemented an aggressive 50 basis-point reduction on September 18.

Markets Anticipate Volatility in Anticipation of the FOMC meeting and Election Day

The presidential election scheduled for tomorrow and the Federal Reserve policy decision scheduled for Wednesday are the primary focus of attention. In anticipation of these significant events, the cryptocurrency markets anticipate increased volatility.

As the election approaches, analysts anticipate that Bitcoin will experience increased volatility. This is likely to induce a “sell-the-news” reaction, reminiscent of previous instances in which market participants responded vehemently to significant news, resulting in price fluctuations.

In the past 24 hours, Bitcoin has decreased by 2% and is presently trading at approximately $67,800, according to CoinGecko Data. Additionally, the aggregate crypto market capitalization decreased by nearly 3% to $2.3 trillion.

The broader crypto market contracts a cold as Bitcoin sneezes. Toncoin and Chainlink experienced a 5% decline, while Ethereum and Solana experienced a decline of over 3% each.

Bitcoin has historically experienced substantial price increases after US elections. For instance, Bitcoin’s value experienced substantial increases in the year following each election cycle following the 2012, 2016, and 2020 elections.

This trend indicates that Bitcoin has the potential to experience a rebound following the election, irrespective of the candidate who emerges victorious.

Nevertheless, the outcome of the election may influence short-term price movements. According to Bernstein analysts, the price of Bitcoin could reach $90,000 in the event of a Trump victory. Conversely, Bitcoin may plummet to $50,000 if Harris prevails.