Binance reports that retail investors, not institutions, have driven spot bitcoin ETF demand since debut.

Retail investors account for the majority of demand for spot Bitcoin exchange-traded funds (ETFs), according to recent research by Binance.

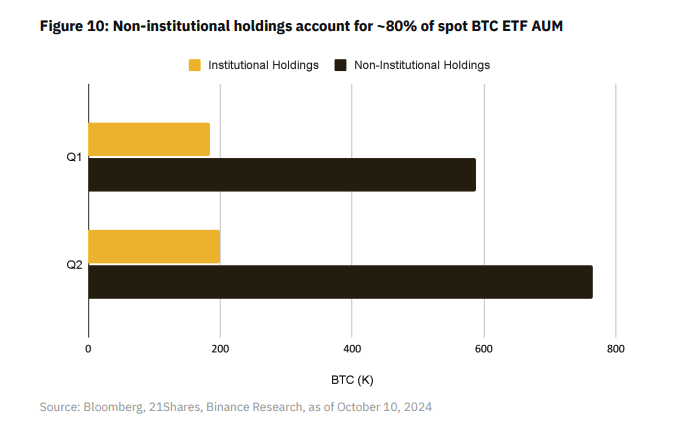

In an October 25 report on crypto ETFs, Binance revealed that as of October 10, nearly 80% of the total assets under management (AUM) in spot BTC ETFs were held by non-institutional investors.

Since the launch of spot Bitcoin ETFs in January 2024, a milestone for the crypto industry, they’ve accumulated $21.6 billion in net inflows over the past 10 months.

However, Binance analysts pointed out that much of the $63.3 billion in total AUM since the ETFs’ inception was not all new investment.

Instead, it appears “a notable portion” of this demand came from retail investors moving their holdings from digital wallets and exchanges to ETFs, which offer more regulatory protections.

Binance wrote, “Spot ETFs are serving dual roles: not only onboarding new investors but also attracting existing investors who prefer the regulated structure of ETFs over other, more complex options, such as direct on-chain holdings or illiquid, high-fee alternatives like Grayscale’s Bitcoin Trust.”

Institutional Demand is Rising

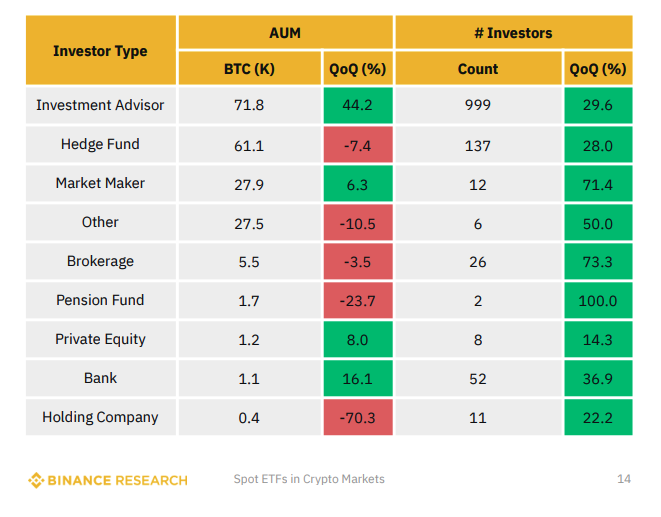

Though retail investors represent the largest share of Bitcoin ETF investments, Binance noted an uptick in interest from institutional investors, particularly from investment advisers and hedge funds.

Many traditional institutions are still cautious about Bitcoin funds, and those invested remain “reserved” with their capital allocations.

While several large financial firms have sought to capitalize on the Bitcoin ETF surge, U.S.-based investment firm Vanguard has been notably reluctant.

As the world’s second-largest ETF issuer, Vanguard has consistently declined to launch Bitcoin or crypto ETFs. CEO Salim Ramji reaffirmed this position on August 14, stating the company will “not be launching any crypto ETFs.”

According to Binance, this “cautious approach” reflects how traditional finance firms generally interact with the crypto space.

“Although institutions are expected to drive trade sizes higher over time, there hasn’t been a material change over the year, likely due to volatile market conditions and global liquidity uncertainties,” the report observed.

Bitcoin ETF Inflows Surge, With Potential Price Impact

Recently, Bitcoin ETFs have experienced an “unusually large” series of inflows, which has led one analyst to caution about a potential price dip for Bitcoin in the near term.

Between October 11 and 23, spot Bitcoin ETFs attracted $2.88 billion in inflows, with only one day of outflows on October 22, totaling $79.1 million — a relative outflow of just 2.7%, as reported by Farside data.