Bitcoin (BTC) made fresh gains overnight on May 31 as the month close was expected to seal losses of around 15%.

Sell triggers accumulate over $33,000

Data from TradingView showed BTC/USD consolidating again after surging to $32,200 on Bitstamp by rebound.

The pair thus ended the second day with more bullish momentum, but that did not impress analysts, who widely believed the moves were unreliable.

Those doubts continued into the day amid disputes over whether recent gains represented a “dead cat bounce.”

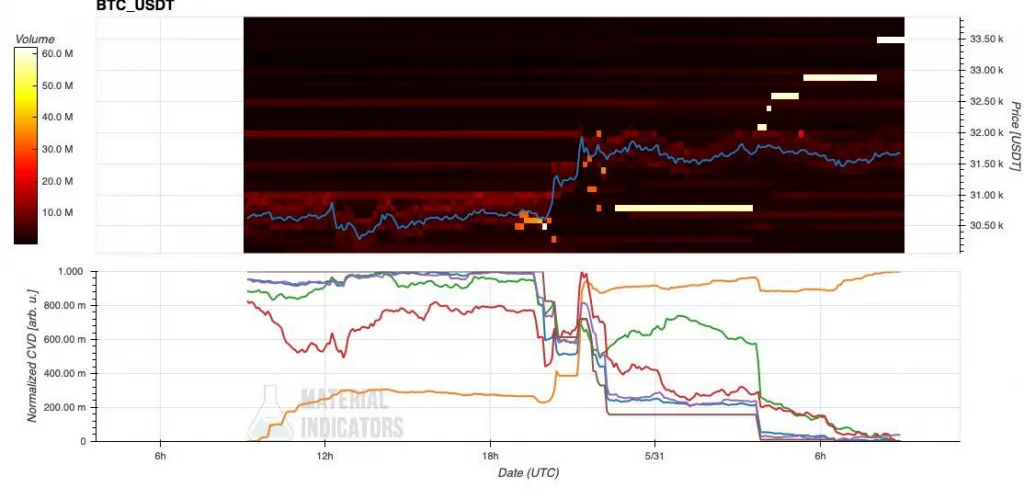

“BTC is ready for a bigger move. Before you begin, consider how cryptocurrencies squeeze shorts and lock longs,” on-chain analytics resource Material Indicators wrote in one of several tweets over the past 24 hours:

“You can mitigate risk by waiting to confirm breakout or fakeout. FireCharts shows where liquidity rests in the order book. Monthly close Tues.”

Meanwhile, order book data from major exchange Binance showed a solid $61 million sell wall, up from $33,500 at the time of writing.

Popular Twitter account Il Capo of Crypto continued its bearish stance while admitting that the bounce went contrary to previous predictions.

The other Venturefounder account added that the BTC/USD pair would need to retrace its 200-day moving average near $43,000 to “resume a fresh bull market,” calling that goal an “uphill battle.”

Whales wait quietly for a good opportunity to do something

Meanwhile, amid the nondescript crowds that accompanied the jump, additional concerns centered on the whales.

As noted by Caue Oliveira, an analyst at Brazilian analytics firm BlockTrends, Bitcoin’s biggest companies have yet to show confidence in recent lows like a macro bottom.

“Whales/institutions still haven’t unleashed their full firepower!” He summed it up in a Twitter thread:

“These large entities continue to reduce activity, exposing their caution with the global scenario. A close look at their moves can provide the true signal of a real reversal.”

An accompanying chart showed a sharp drop in whale movements in May.

Oliveira continued that activity on institutional platform Coinbase Pro also suggests that most investors are waiting on the sidelines.

“Right now I don’t see any sign of a real ‘buy the dive’ from these participants,” he added.

Whalemap-focused monitoring resource Whalemap went on to claim that without a breakout of the 200-week moving average, Bitcoin is yet to reach a true macro bottom.

This moving average was around $22,200 on May 31st.