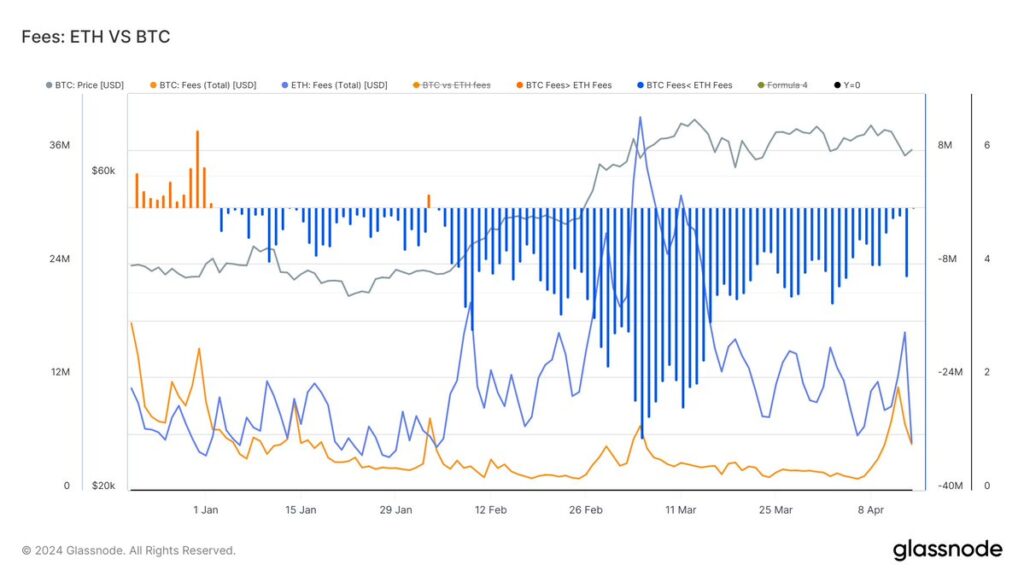

The approaching Halving event caused Bitcoin (BTC) transaction fees to hit an all-time high of $11 million in a single day. Notably, throughout April, the hash rate rose by 4%.

Transaction fees for Bitcoin (BTC) reached an all-time peak of $11 million in a single day due to the impending Halving event.

The surge in activity observed can be attributed to users hastening to secure transactions in anticipation of the Halving, an event anticipated to transpire within the next few days.

Bitcoin Hash Rate Rises Ahead of Halving

A further indication that Bitcoin mining is consuming unprecedented computational power is the hash rate, which has topped 625 exahashes per second (EH/s).

Significantly, the hash rate increased by 4% during April.

Furthermore, this suggests a substantial increase in mining operations as participants strive to optimize their earnings before the halving, which diminishes the block reward.

Moreover, analysts and stakeholders in the cryptocurrency industry have provided divergent opinions regarding the potential ramifications of the forthcoming Bitcoin halving.

Ahead of an impending Halving event that reduces the rate of new Bitcoin creation, crypto traders are also contemplating whether Bitcoin’s recent surge is merely the start of a darker period in 2024.

Prior Bitcoin halving events in 2012, 2016, and 2020 all ignited substantial price increases.

Diverse predictions exist, but Bitfinex analysts anticipate a 160% price increase over the next 12 to 14 months, possibly surpassing $150,000, following the halving.

However, David Mercer of LMAX Group and other skeptics raise doubts regarding the likelihood of another bull run, implying that the recent ascent of Bitcoin may have already accounted for the effects of the Bitcoin Halving.

Bitcoin Price Crash Continues

Since January, Bitcoin’s price has increased by 60%, reaching a record high of $73,803.25 in March.

Enthusiasm for new U.S. spot Bitcoin ETFs and institutional investment contributed to the surge.

According to analysts at Bitfinex, the anomaly that Bitcoin has already reached an all-time high before the halving incorporates uncertainty into market dynamics.

Conversely, speculators anticipate the April 20 Halving with a mixture of sentiments.

Whether it will spark another steep rise or Bitcoin’s trajectory has already accounted for the event’s effects is a matter of disagreement.

Moreover, skepticism has increased since the most recent collapse of Bitcoin prices.

The Bitcoin price decreased 4.83 percent to $62,936.44 as of Tuesday, April 16, 2024.

Meanwhile, its market capitalization was $1.23 trillion. In contrast, the Bitcoin transaction volume increased by 6.93 percent in the previous twenty-four hours, reaching $45.86 billion.

Nonetheless, massive selloffs during the collapse precipitated this increase in volume.