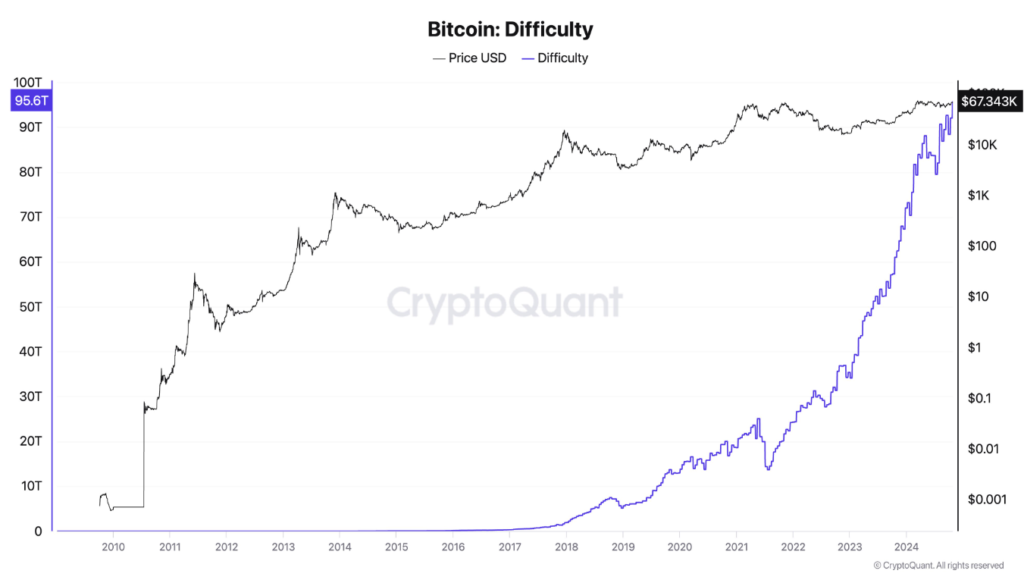

Bitcoin mining difficulty has risen 378% in three years due to institutional investments, increasing competition and limiting individual miners.

Bitcoin mining has become significantly more difficult over the course of the past three years, with the difficulty level increasing by 378 percent as a result of institutional investment in large-scale mining operations.

This has led to unprecedented competition in the mining industry and entry restrictions for miners. Ki Young Ju, the Chief Executive Officer of CryptoQuant, speculated that this could be a beneficial thing for Bitcoin.

According to Ju’s projections, the rise in the difficulty of mining BTC could be a forerunner to the phenomenon of BTC being a stable currency by the year 2030. According to Ju, in the BTC industry, the potential for increased institutional dominance could lead to a reduction in volatility.

BTC and the cryptocurrency market have been volatile during recent years, making them more speculative than stable. Mining has become more difficult as a result of the increasing engagement of institutional investors, which has occurred concurrently with the centralization of processing capacity, nonetheless, Ju thinks that this could help stabilize the Bitcoin ecosystem.

According to a statement made by Ju in a post on X, “major fintech players are expected to drive mass adoption of stablecoins within three years”. By the time the second halving event occurs in 2028, he predicts that serious discussions about the use of BTC as a currency will begin.

The adoption rates of layer-2 solutions, such as the Lightning Network, have lagged behind those of blockchains sponsored by venture capital (VC), despite the fact that these solutions have been hailed as essential to how scalable BTC is.

As Ju pointed out, institutional support is very necessary for the implementation of Bitcoin L2s, which are up against competition from alternative alternatives such as wrapped bitcoin. WBTC allows for the seamless integration of Bitcoin into various ecosystems, eliminating the need for complex L2 infrastructure.

After reaching $69,000 for the first time since June, the cryptocurrency reached $69,000 on October 21. According to the analysis of the Bitcoin price, the $65,000 price level has become a fundamental support for the cryptocurrency.

Keith Alan, co-founder of Material Indicators, predicted that the short-term rally is here to stay if the price of Bitcoin “can hold above the 21-week moving average with no wicks.

Analysts will closely monitor the performance of BTC in the coming weeks, with some anticipating a retest of its all-time high before the year ends. This is due to the presence of macroeconomic data and anticipated market volatility.