Bitcoin, the world’s largest cryptocurrency made a shocking rally above $30,000 in its last weekly close. This is its first-ever positive close over the last ten weeks.

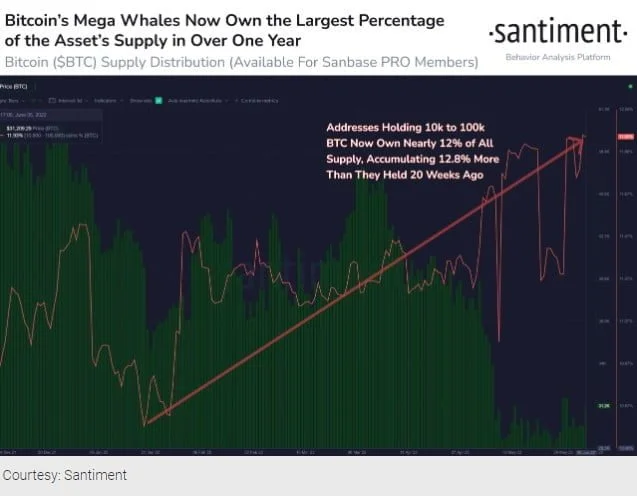

Bitcoin is currently trading 4.32% higher for $31,096 and a market capitalization of $589 billion as of the time of writing. Santiment, an on-chain data provider, reports that Bitcoin’s total whale holdings have reached a one-month high. It states:

The mega whale addresses of Bitcoin, comprised partially of exchange addresses, own their highest supply of $BTC in a year. We often analyze the 100 to 10k $BTC addresses for alpha, but accumulation from this high tier can still be a promising sign.

Will Bitcoin’s price rally be momentary or last?

Over the last week, there has been a fierce battle between Bitcoin bulls and bears. As a result, the price of BTC has been fluctuating below and above $30,000. Katie Stockton, the co-founder of Fairlead Strategies, wrote in a note to clients last Friday that:

Bitcoin has stabilized over the past few weeks on improved short-term momentum. A short-term counter-trend buying signal was logged by Tom DeMark’s TD Sequential model, increasing the probability of a more pronounced oversold bounce. We assume the 50-day moving average will provide resistance.”

Bitcoin has been closely following the performance of the United States equity market. Furthermore, the crypto market is being weighed down by the significant uncertainty in the global macro scenario.

Several miners have started selling their Bitcoins at low prices to cover their operating costs in the last month. This includes both large and small mining companies.

Cathedra Bitcoin Inc., a small-scale miner, had to sell practically all of its holdings to keep its company running. AJ Scalia, Cathedra’s Chief Executive Officer, stated:

“We have spent the last several weeks restructuring our balance sheet and operations to ensure Cathedra is well-positioned to endure a prolonged economic downturn”.

Many have speculated that the United States will see a serious economic collapse in the next 12 to 18 months. In this case, BTC has the potential to crush beneath $25,000, if not more.