Digital asset inflows last week hit $901 million, led by Bitcoin amid growing investor optimism ahead of US elections.

Last week, digital asset inflows soared to $901 million, with Bitcoin capturing most of the investment.

This October, BTC has emerged as a top pick among investors, especially with the upcoming U.S. elections in November.

Meanwhile, Ethereum (ETH) has seen significant outflows, and altcoins like Solana and Litecoin are gaining increased attention.

Bitcoin Leads Crypto Inflows

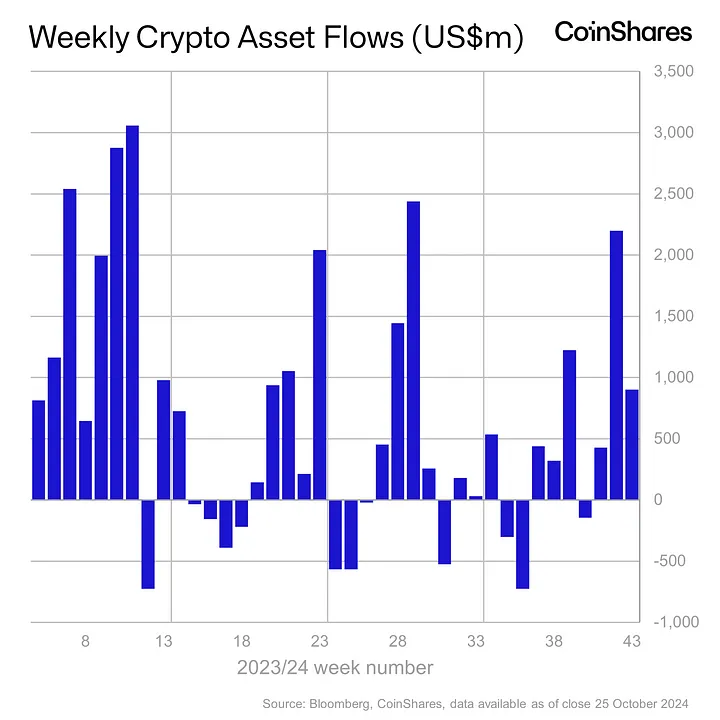

CoinShares’ latest report shows that digital asset investment products received $901 million in inflows, representing 12% of the total assets under management for October.

This figure marks the fourth-largest monthly inflow ever recorded. So far in 2024, year-to-date inflows have reached $27 billion, almost three times the previous record of $10.5 billion set in 2021.

Bitcoin dominated inflows, with BTC investment products pulling in an impressive $920 million. This suggests major investors are capitalizing on recent BTC dips, especially with bitcoin price drop to $65,000 last week.

Meanwhile, short BTC products saw a minor outflow of $1.3 million. K33’s head of research, Vetle Lunde, noted:

“Record year in the making! Net yearly notional flows to BTC investment vehicles have surpassed the 2020 peak. In 2024, Bitcoin investment vehicles globally have seen net yearly inflows of 377,000 BTC, surpassing the Grayscale-led 2020 record of 373,000 BTC.”

Spot Bitcoin ETFs were a substantial driver, with $998 million in inflows over five days between October 21 and October 25.

The BlackRock ETF (IBIT) recorded a notable net inflow of $1.15 billion, while the ARK 21Shares Bitcoin ETF (ARKB) experienced a net outflow of $206 million.

Spot BTC ETFs are now nearing a major milestone, holding close to 1 million BTC, or nearly 5% of the total Bitcoin supply—an impressive achievement within just 10 months of launch.

Solana and Litecoin Gain Traction Ahead of U.S. Elections

In the altcoin market, Ethereum (ETH) has seen $35 million in outflows, as it loses appeal as a “Trump-trade” ahead of the elections, despite an overall positive market sentiment.

In contrast, Solana experienced the second-largest inflows last week, attracting $10.8 million. Many analysts anticipate Solana’s price could rally to $300.

Litecoin, another Bitcoin alternative, has also seen increased activity, with its price currently around $70 and potentially aiming for a climb to $100.