Over the past week, Bitcoin whales have amassed a substantial quantity of BTC as the halving date approaches on April 20.

A week remains until the fourth Bitcoin halving, during which the block reward will be reduced to 3.125 BTC. The increasing demand from whales serves as an indication of favorable market sentiment.

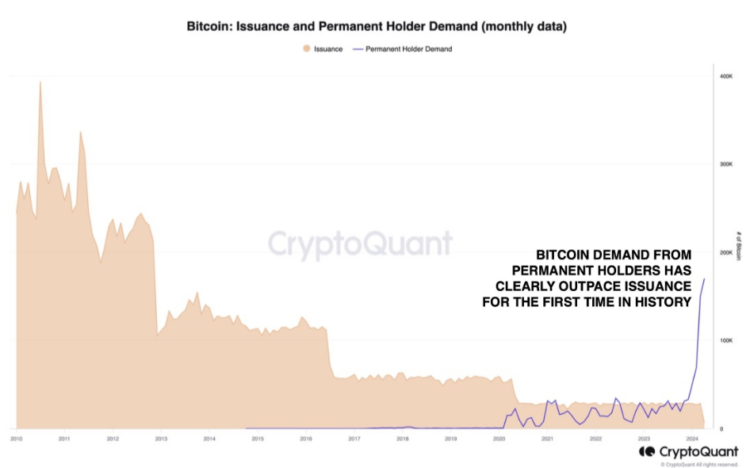

Data from the crypto analytics firm CryptoQuant indicates that the demand from Bitcoin billionaires has increased at an unprecedented rate.

For the first time, the demand from “permanent holders” has surpassed the supply of new Bitcoin on the market. This suggests that the amount of newly mined Bitcoin needs to be improved to satisfy the demand of cryptocurrency investors, and the scarcity will only increase after the Bitcoin halving.

Increasing spot Bitcoin inflows and the growing demand from BTC billionaires will exert upward pressure on the leading cryptocurrency’s price. Over the medium to long term, this trend can contribute to the continued appreciation of Bitcoin’s value.

Price fluctuations frequently precede and ensue after the Bitcoin halving, which is a watershed moment in the cryptocurrency ecosystem.

Each bull run has historically begun months before the halving, anticipating the reduced BTC supply. The price of Bitcoin experiences a multiplication after halving as a result of the reduced supply and the widening supply-demand imbalance.

Bitcoin halvings affect miners’ accountability for transaction verification and the addition of new blocks to the blockchain, in addition to the direct effect on supply.

Each halving reduces miner earnings by half, thereby causing an increase in the cost of producing new BTC. Bitcoin must, therefore, reach a certain price threshold before miners can resume operations.

Profitable at the current trading price of around $70,000, the average cost of mining one Bitcoin is approximately $49,000; however, prices must surpass $80,000 after the halving of Bitcoin for miners to continue operating profitably.

A bullish indicator for the cryptocurrency market, the whale accumulation phase signifies that large BTC holders are transferring their holdings to cold wallets in anticipation of a price increase.