Bitcoin whales transferred $3 billion BTC recently. The German and U.S. government dump alongside Mt. Gox concerns suggest a further drop.

Bitcoin whales have piqued the market’s interest, transferring approximately $3 billion in BTC across numerous transactions.

The BTC price experienced a significant decline today, while Whale Alert reported numerous whale transactions.

Bitcoin’s recent decline to $57,000 has caused a significant rumbling in the crypto market, eliciting a new surge of concern among investors.

With the flagship cryptocurrency experiencing a nearly 5% decline today, concerns regarding a more substantial decline are being exacerbated by government Bitcoin transfers and whale movements.

Notably, a prominent whale’s decision to sell 3,500 BTC to Binance during the downturn has increased market concerns, as traders prepare for potential future losses.

Bitcoin Whale Activity Sparks Concern Over Stability

Whale Alert, a prominent on-chain transaction tracker, has recently reported that Bitcoin whales have transferred a substantial quantity of BTC, which has sparked market speculation.

Notably, the whales transferred about $3 billion in BTC in multiple transactions, while Bitcoin price experienced a significant decline.

However, the recent dump of 3.5K BTC has garnered significant attention.

The abrupt transfer of 3,500 BTC, valued at approximately $206 million, to Binance by a significant whale has sparked discussions.

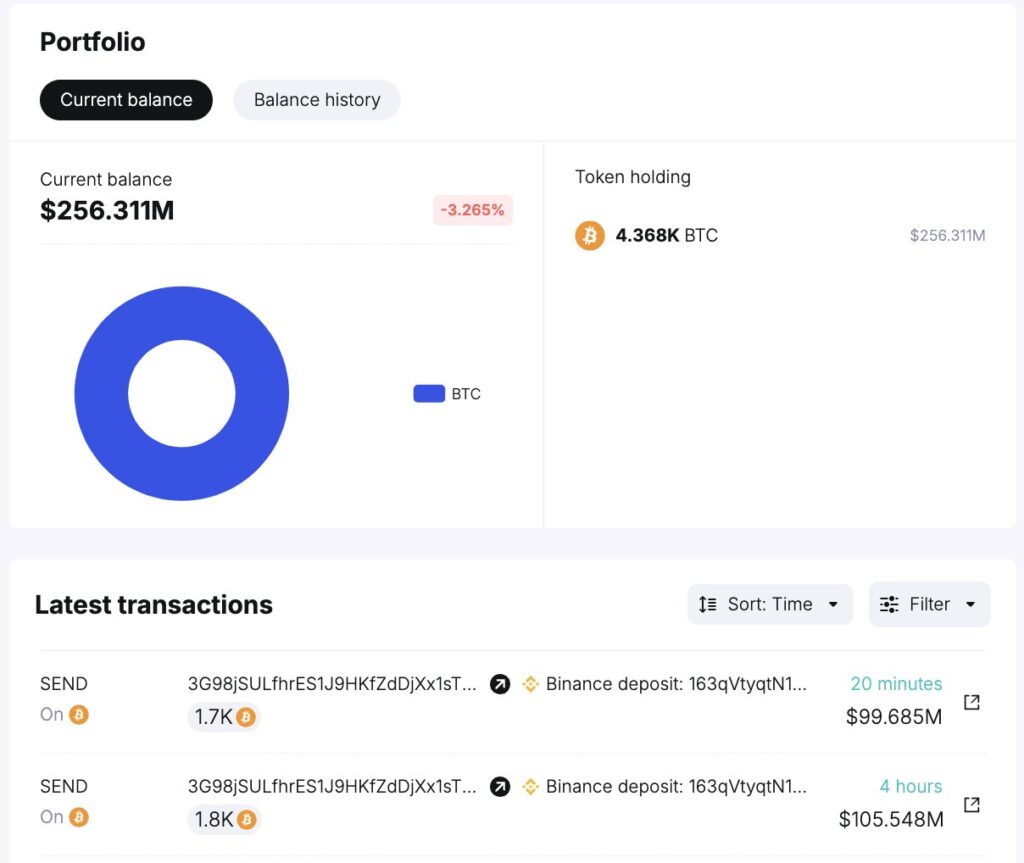

In the most recent transfer, this whale transferred 1,700 BTC to Binance, which is estimated to be worth $99.9 million, according to Spot On Chain.

Notably, the total dump by the same whale totaled 3.5K BTC, as per the report.

The average price per BTC for these transactions was $58,891.

However, following the sell-off, the whale still has a balance of 4,368 BTC, worth around $256 million.

Meanwhile, some market participants also predict that the whale may continue to unload, which could exacerbate the bearish sentiment in the crypto market.

In contrast, Whale Alert has emphasized the reactivation of a long-dormant address that contains 119 BTC.

Meanwhile, this address, which had been inactive for over 12 years, acquired its Bitcoin for a mere $599 each in 2012.

The present market dynamics are further complicated by the awakening of this wallet, which currently contains BTC valued at approximately $7 million.

Market analysts are eagerly monitoring these whale activities.

Prominent crypto analyst Ali Martinez remarked, “The Bitcoin dip keeps dipping because too many people keep buying the dip!”

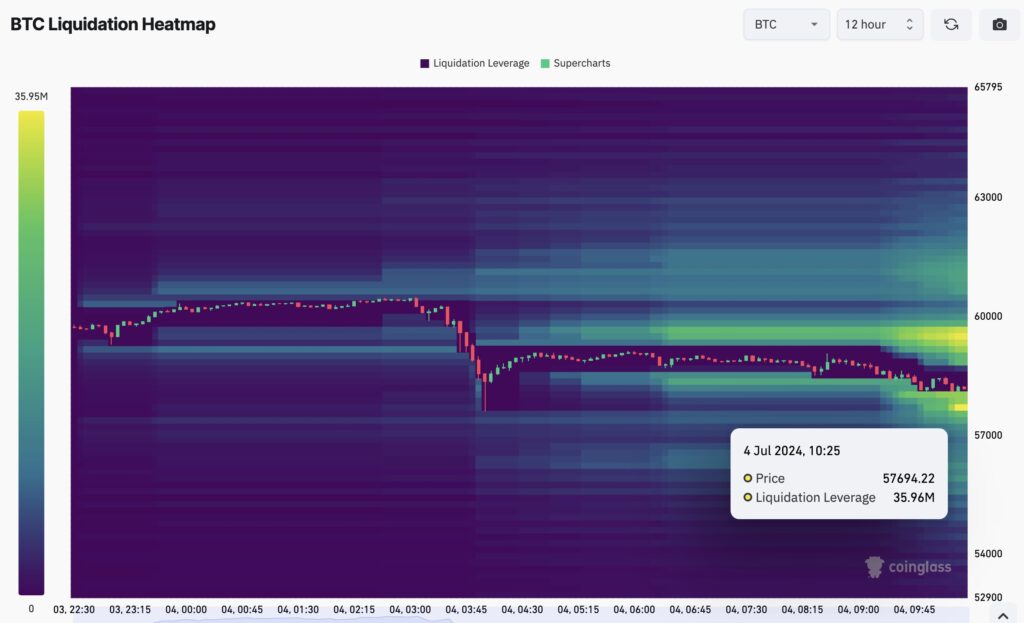

In addition, he observed that a $36 million liquidation pool is currently at $57,700, which implies that there is potential for volatility in the future.

Government Dump & Mt. Gox Payout Further Adds To Bearish Sentiment

The German government’s recent Bitcoin sales have sparked concerns and added to the gloomy momentum.

Today, the German authorities transferred 1,300 BTC to prominent exchanges such as Kraken, Bitstamp, and Coinbase, thereby increasing market volatility.

This substantial decrease has been the source of concern that the decline of Bitcoin may be further exacerbated by additional sales of this nature.

In addition, Arkham Intelligence has reported that the U.S. government recently transferred 237 BTC, which is equivalent to approximately $14 million, to a wallet.

This action has prompted speculation regarding potential future price declines.

Observers are apprehensive about the potential for government actions to induce further market declines, which would exacerbate the ongoing volatility.

Conversely, ongoing uncertainties regarding the repayment plan for Mt. Gox have also caused market volatility.

Starting in July, creditors of the exchange that collapsed are expected to receive approximately 142,000 BTC, which is equivalent to nearly $9 billion.

The anxiety regarding potential downward pressure on prices is contributing to the anticipation of this substantial discharge of Bitcoin into the market.

Meanwhile, the combination of whale activities, government BTC sales, and the impending Mt. Gox payouts has created a cocktail of factors contributing to Bitcoin’s current instability.

Traders and investors are anticipating potential further declines as the market processes these developments.

Bitcoin’s one-day trading volume increased by 51% to $37.59 billion, while its price declined by 4.56% and was trading at $57,850.23 at the time of writing.

In the last 24 hours, the cryptocurrency has fluctuated between a high of $60,558.36 and a low of $57,338.45.

Additionally, the Bitcoin Futures Open Interest has decreased by over 4% in the past 24 hours and about 2% in the past four hours, according to CoinGlass data.