Bitcoin’s Long Condor options strategy allows traders to place bullish bets without taking on liquidation risks.

Long-dated Bitcoin options and bulls continue to make headlines with their ultra-bullish bets, but even they must admit that the likelihood of (BTC) trading above $60,000 in the next few months is remote at this point.

While many traders have increased their leveraged long positions through futures contracts in order to chase after the elusive all-time high, this appears to be an unrealistic expectation.

The popular on-chain analyst Willy Woo predicts that Bitcoin’s price will reach the $50,000 to $65,000 range in the coming sessions as a result of exchange outflows and accumulation from BTC miners and whales.

Even Gary Gensler, the Chairman of the United States Securities and Exchange Commission, believes that cryptocurrencies will not be phased out and will likely play a significant role in the financial industry in the foreseeable future. So being moderately bullish for the next couple of months will most likely result in positive outcomes. –

The “long condor with call options” strategy may be more advantageous for bullish traders who believe the Bitcoin price will break to the upside but are unwilling to take on the liquidity risks associated with futures contracts.

Options are sure bets for avoiding liquidations

Developing custom strategies in the options market is more flexible than in other markets, and there are two instruments available. Buying a call option provides buyers with upside price protection, whereas buying a protective put option provides the buyers with the opposite protection. To create unlimited negative exposure, traders can also sell the derivatives in the same way that they would with a futures contract.

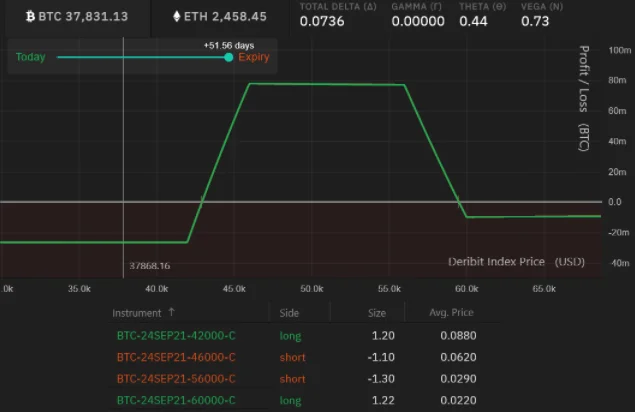

Using a slightly bullish range, this long condor strategy is scheduled to expire on September 21. However, we will assume that the majority of traders are looking for opportunities to profit from the market’s rise in value.

Despite the fact that Bitcoin was trading at $37,830 at the time of the pricing, a similar result can be obtained starting from any price level.

A positive exposure above this price level is achieved by purchasing 1.20 BTC worth of $42,000 call options in the first trade. The trader must then sell 1.1 BTC contracts of the $46,000 call in order to keep gains below $46,000.

1.3 BTC contracts of the $56,000 call are required to complete the strategy, thereby limiting the potential gains above this price level. Then, if Bitcoin unexpectedly skyrockets in value, a $60,000 upside protection call for 1.22 BTC is required to limit the losses.

The gain obviously outweighs the loss in this situation

Although the strategy appears to be difficult to execute, the required margin is only 0.0265 BTC, which is also the maximum loss. If Bitcoin trades between $42,950 (up 13.5 percent) and $59,450, the potential net profit is $4,950. (up 57 percent ).

When considering whether to close a position prior to the September 21 expiry date, traders should keep in mind that if there is sufficient liquidity, it is possible to do so. Using 0.0775BTC, the maximum gain is between $46,000 and $56,000, which is nearly three times greater than the maximum loss.

Due to the fact that there is no risk of liquidation, unlike futures trading, this strategy provides peace of mind to the holder with over 50 days until the expiry date.

The fact that most derivatives exchanges accept orders as low as 0.10 Bitcoin contracts is another advantage, as it allows traders to develop the same strategy with a much smaller investment.

Unless otherwise stated, the views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Cointelegraph. A degree of risk is inherent in every investment and trading move. When making a decision, it is important to do your own research….