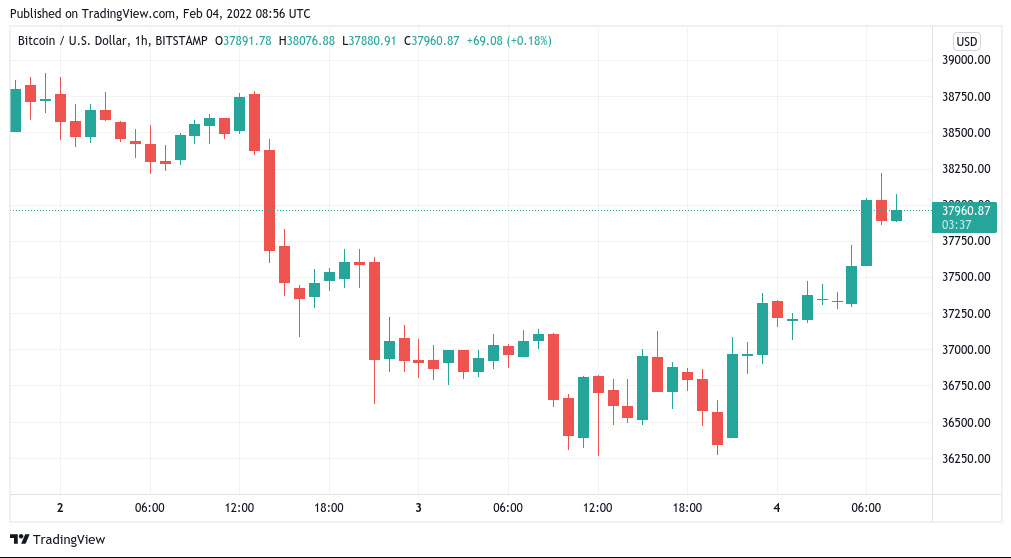

Bitcoin regained a significant portion of its recent losses on February 4, but there was still anxiety that a retest of the $30,000 mark was on the horizon.

Bitcoin is most likely to maintain its current price of $38,600

According to TradingView, the Bitcoin/USD exchange rate returned to $38,000 on Friday, an increase of more than 2 percent in only 24 hours.

After being subjected to the wrath of stock sellers in the United States for two days in a row, the pair made a powerful rebound overnight.

Later on Thursday, a similar turnaround in tech stocks, with Amazon rising 15 percent, laid the scenario for Bitcoin to surge in lockstep, despite Bitcoin proponents condemning the excessive volatility of some shares.

The recovery, on the other hand, may go some way toward preventing a more significant regression in Bitcoin’s price, which is still supported by writer Michael van de Poppe as a “probable” move.

Ultimately, he claimed late Thursday, “the most likely scenario is another sweep of the lows for Bitcoin around $30-33K, and following that, we establish a bullish divergence and the fun continues.”

It was reaffirmed by him that the region around $38,600 needs still be broken and held in order for a paradigm change to take place.

According to a recent tweet from another trader and analyst Rekt Capital regarding the same level, “BTC is still producing an indecisive candle just below the major barrier of $38650.”

“That said, for the time being BTC is able to hold the top of last week’s candle as support. Technically, BTC is still inside the 28000-$38000 range until further notice.”

Pentoshi adopted broader timeframes, punctuating months of cautious predictions for Bitcoin with renewed optimism in the cryptocurrency’s return.

As $BTC enters the green zone. My Bera watch ends, and bulla watch beginsCrazy how that works. Months of macro based bear posting after a deviation. Soon most will think it’s over, when it really just beginsBillionaires, nations, institutions compete for scarcity(X) — Pentoshi DM’S ARE SCAMS (@Pentosh1) February 3, 2022

Based on the TradingView report, on-chain indicators are predicting another rally this week, breaking out of a two-month downward trend.

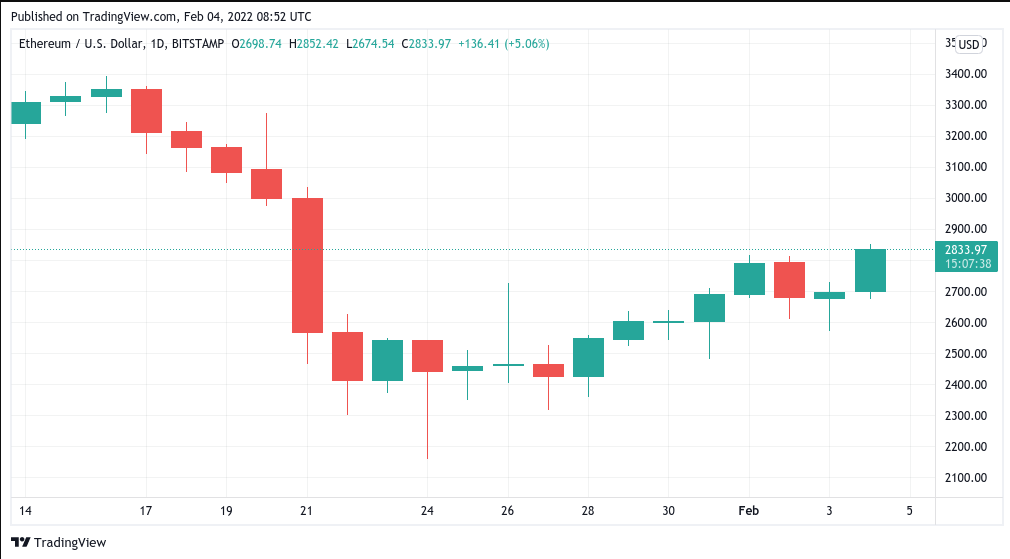

Ethereum reaches a two-week high above $2,800

On the cryptocurrency front, Ether (ETH) and Solana (SOL) were the top performers on the day, both registering 24-hour increases in excess of 5 percent.

Because trader and Bollinger Bands author John Bollinger said that present levels were a good purchase zone for his ETH allocation, ETH/USD surpassed BTC/USD to cross $2,800.

This seems like a good add-to spot for my $ethusd position.— John Bollinger (@bbands) February 3, 2022

“Ethereum is acting even stronger than Bitcoin here,” Van de Poppe noted, as the largest cryptocurrency by market cap touched its highest levels since Jan. 21.