Bitcoin’s unpredictable price swings continue to frustrate investors, impacting altcoins significantly.

Investors remain frustrated by the unpredictable nature of Bitcoin’s price fluctuations. It is becoming increasingly difficult to forecast the trajectory of prices. Occasionally, BTC invalidates upward predictions with declines.

Occasionally, BTC is predicted to decline to levels below $60,000. The ascent of Bitcoin renders these levels invalid. Regrettably, altcoins are primarily impacted by the market’s fluctuations. Altcoins are currently in a precarious position.

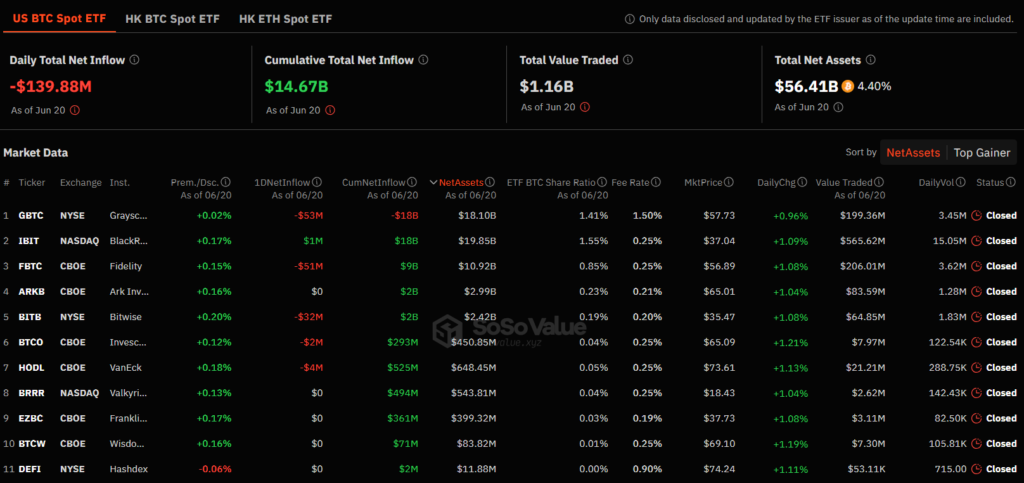

Yesterday, $139.88 million was withdrawn from spot Bitcoin ETFs in the United States. Grayscale exited with the most substantial amount, $53 million. The spot Bitcoin ETF from Fidelity experienced a $51 million exit following Grayscale.

BlackRock’s $1 million inflow was the sole inflow into spot Bitcoin ETFs, which was noticeable among the reds.

Conversely, some spot Bitcoin ETFs had no activity, as is customary. During my news reports, these ETFs typically register zero. Yesterday, Ark Invest, Valkyrie, Franklin, WisdomTree, and Hashdex all recorded zero transactions.

The current expectation among crypto investors is that Bitcoin will stabilize at or above $70,000. Altcoins may also experience a resurgence if BTC initiates a new upward phase and surpasses $80,000. Nevertheless, the situation for altcoins may deteriorate if BTC is unable to accomplish this. Numerous altcoins may revisit their 2023 lows.