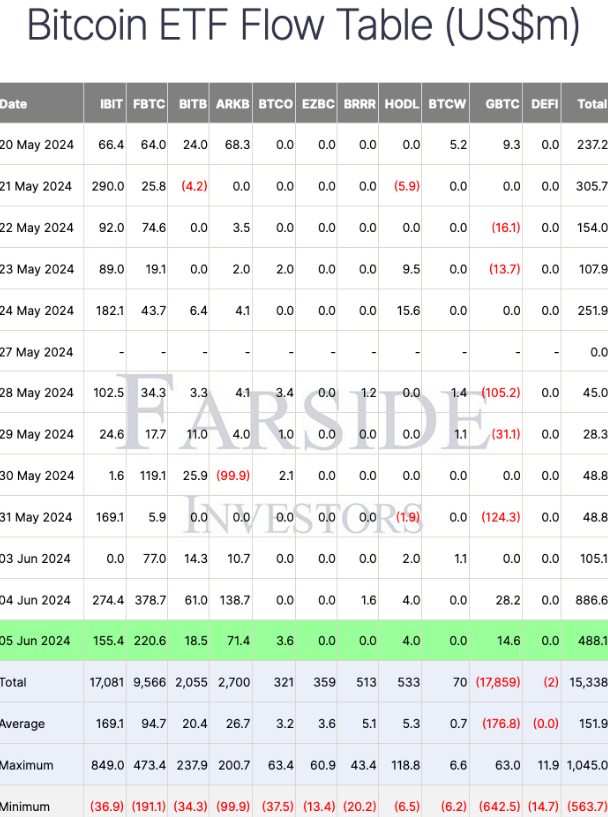

On June 5, bitcoin exchange-traded funds (ETFs) in the US experienced an inflow of $488.1 million. However, Google data indicates a significantly lower volume of search.

On June 4, the ETFs experienced their second-highest inflow day, totaling $886.6 million. Farside Investors data indicates that the Fidelity Wise Origin Bitcoin Fund (FBTC) accounted for the largest share of inflows at $220.6 million, with the following day’s performance approximately half that amount.

The Grayscale Bitcoin Trust (GBTC), which has experienced net outflows exceeding $17.8 billion since January, experienced a $14.6 million net inflow, while BlackRock’s iShares Bitcoin Trust (IBIT) was second with $155.4 million.

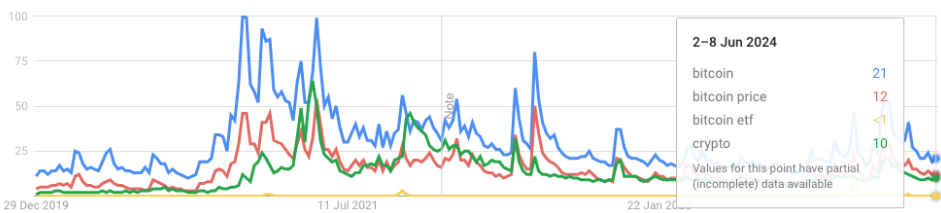

In contrast to 2021, Google Trends data indicates that a negligible number of Americans are undertaking searches related to Bitcoin, Bitcoin ETFs, its price, or crypto in general, despite the substantial inflows and a Bitcoin rally that exceeded $71,000.

Google Trends data, which assigns a value out of 100 based on the relative peak prevalence of search interest, provided a score of 31 for searches for “Bitcoin” that originated from the United States on June 5, while “Bitcoin ETF” received a score of 1.

While other searches, such as “Bitcoin price” and “crypto,” have achieved a higher index score of 18 and 13, respectively, they remain significantly lower than those achieved during the retail-driven bull run of 2021.

The interest in crypto-related search terms had decreased over the past year, with a general increase in interest on January 11 (the day the U.S. approved ten spot Bitcoin ETFs) and March 5, when Bitcoin broke above $69,000 for the first time since 2021.

The pinnacle of search interest for “Bitcoin” occurred in May 2021. It crossed the $50,000 threshold for the first time a few weeks prior and would reach its all-time peak of nearly $69,000 in November 2021.

Additionally, Miles Deutscher, a crypto analyst, disclosed data in a June 6 X post that indicated the viewership of crypto-related YouTube channels had declined substantially from 2021, despite Bitcoin having already transcended its peak price at that time.

The daily viewership of crypto YouTube has decreased from approximately 4 million views in 2021, when Bitcoin reached its then-peak, to approximately 800,000 in 2024, despite BTC reaching new highs.

Deutscher asserted that retail has yet to recover. “There is no other indicator in the world that more accurately represents the current state of the market than crypto [YouTube] views.”