Bitcoin miner Bitfarms plans to upgrade its mining hardware with an expenditure of around $240 million to increase its hash rate after the 2024 Bitcoin halving.

Performance and profitability are the main priorities of Bitfarms’ preparation efforts for the Bitcoin halving. In an interview, Jeffrey Lucas, the chief financial officer of Bitfarms, outlined the company’s efforts to hire 88,000 highly productive Bitcoin miners.

Bitfarms had previously bought 35,888 Bitcoin Miner T21s from Bitmain. In addition, there have been purchases of 19,280 Bitmain T21 miners, 3,888 Bitmain S21 miners, and 740 Bitmain S21 hydro miners in addition to the exercise of a purchase option to acquire an extra 28,000 T21 miners.

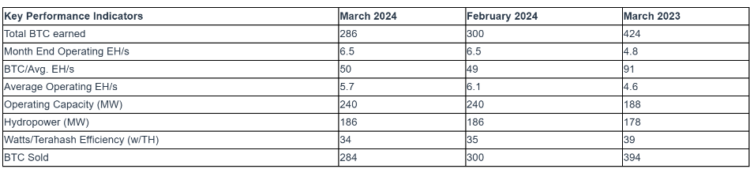

By March 2024, Bitfarms had generated 286 BTC from mining at a monthly rate of 6.5 exahashes per second (EH/s).

The company mined 424 BTC in March 2023 at a rate of 4.8 EH/s, demonstrating how crucial it is to increase hash rate capacity to continue mining Bitcoin profitably.

To finance the expansion of its mining fleet, Bitfarms sold almost all of the Bitcoin it had mined during the previous two months. Lucas outlined the consequences of the fleet modernization:

“The transformational fleet upgrade propels Bitfarms in scale and profitability amid the Bitcoin halving. This is a game changer that triples our hash rate to 21 EH/s, increases our targeted operating capacity by 83% to 440 megawatts (MW), and improves fleet efficiency by 40% to 21 w/TH.”

Bitfarms has $123 million in total liquidity as of March 31. It has $66 million in cash and 806 BTC in its treasury, valued at $56.7 million at $70,400 on March 31.

Lucas said, “Our proven ability to use our operational expertise to achieve industry-leading performance and profitability is the foundation for the success of our upgrade program.”

Recently, Texas-based Bitcoin miner Giga Energy extended its operations into Argentina to use the waste energy from “natural gas flaring” on the oil fields of that South American country.

Burning natural gas when extracting oil is known as gas flaring. Giga uses the methane it releases throughout the process to power its Bitcoin mining equipment by turning it into electricity.

However, the company doesn’t anticipate making money as it still needs to import all the equipment required to expand its mining activities in the area.