BlackRock has filed an amendment with the SEC addressing investor concerns about Coinbase’s on-chain settlement methods for ETFs.

As a result of significant investor concerns regarding Coinbase’s onchain settlement methods, the largest asset manager in the world has submitted a request for an adjustment to its Bitcoin exchange-traded fund (ETF).

BlackRock filed a filing with the Securities and Exchange Commission (SEC) on September 16, submitting an amendment that would require Bitcoin withdrawals from the custodian of the exchange-traded fund (ETF), Coinbase, to occur within a twelve-hour period.

The following is what BlackRock noted in the filing:

“Subject to confirmation of the foregoing required minimum balance, Coinbase Custody shall process a withdrawal of Digital Assets from the Custodial Account to a public blockchain address within 12 hours of obtaining an Instruction from Client or Client’s Authorized Representatives.”

“BlackRock’s new amendment follows widespread industry concerns about Coinbase’s ETF custodial practices.” Investors are increasingly demanding Coinbase to provide on-chain verification for Bitcoin purchases made on behalf of their exchange-traded funds (ETFs).

Ten out of eleven spot Bitcoin exchange-traded funds (ETFs) and eight out of nine recently approved Ether (ETH) ETFs in the US are under the custodianship of Coinbase.

Coinbase CEO clarifies investor concerns over Coinbase’s Bitcoin ETF custody practices

In spite of the recently discovered institutional inflows from Bitcoin exchange-traded funds (ETFs), the price of Bitcoin has remained unchanged for the past three months.

Because of this, numerous investors became concerned that Coinbase was purchasing “paper BTC,” also known as Bitcoin IOUs, on behalf of Bitcoin ETF issuers, which would result in a decrease in the price of Bitcoin.

Brian Armstrong, the co-founder and CEO of Coinbase, asserts that blockchain ultimately resolves all exchange-traded fund (ETF) transactions, even though not all ETF addresses are publicly visible.

In response to investor concerns, Armstrong wrote in a post on September 14th, X:

“If you want audits, Deloitte audits us annually, we’re a public company. I doubt our institutional clients want people dusting all their addresses, and it’s not our place to share for them. This is what it looks like if you want a bunch of institutional money to flow into Bitcoin.

Investor concerns began to intensify in August after Coinbase first teased the development of a new wrapped bitcoin (WBTC), called Coinbase BTC (cbBTC).

BlackRock and Bitcoin ETFs aren’t the cause of the BTC price slump: Analyst

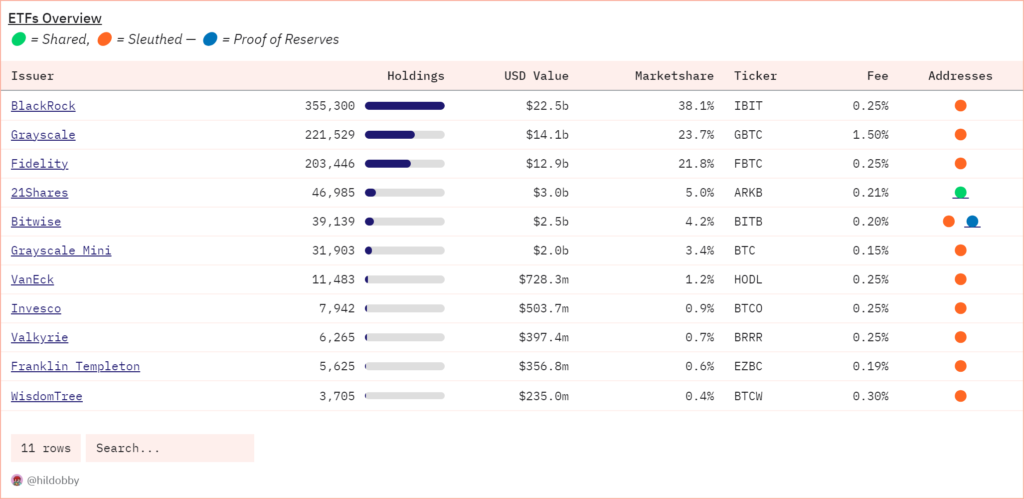

According to Dune data, the exchange-traded funds (ETFs) have accumulated over $59.2 billion worth of cumulative onchain holdings since their launch in January.

With a market share of more than 38 percent and on-chain holdings worth more than $22.5 billion, BlackRock’s IBIT continues to be the largest Bitcoin exchange-traded fund (ETF).

Eric Balchunas, a senior ETF analyst at Bloomberg, asserts that local Bitcoin investors caused the current price collapse in Bitcoin, not exchange-traded funds (ETFs).

Despite the growing number of assertions that this is the case,The analyst noted in a September 15 (X) article that by February 15, exchange-traded funds (ETFs) accounted for approximately 75% of new investment in Bitcoin, which had surpassed the $50,000 mark.

“I get why these theories exist and ppl want to scapegoat the ETFs. Bc it is too unthinkable that the native HODLers could be the sellers. But they are… All the ETFs and BlackRock have done is save BTC’s price from the abyss repeatedly.”