BlackRock and Fidelity Bitcoin ETFs received inflows of approximately $870 million in response to the substantial increase in BTC’s price.

On March 13, 2024, the U.S. Bitcoin ETF market experienced a substantial increase in inflows, with Fidelity’s FBTC and BlackRock’s IBIT taking the lead with a combined value of almost $870 million.

Significantly, amid this surge, the U.S. Bitcoin ETF experienced a considerable inflow of approximately $700 million, indicative of the institutional participants’ intense interest.

Notably, several market analysts have ascribed the recent substantial inflow into the U.S. Spot Bitcoin ETF to the recent upswing in Bitcoin price.

BlackRock & Fidelity Bitcoin ETFs Lead Inflows

As per Farside Investors report, the U.S. Spot Bitcoin ETF received an inflow of $684.7 million on Wednesday, March 13.

Moreover, the ongoing substantial influx this week, particularly in light of Bitcoin’s unparalleled upswing, indicates the considerable attention that Wall Street participants are paying to the leading cryptocurrency.

In the Bitcoin ETF contest, BlackRock’s IBIT and Fidelity’s FBTC emerged as frontrunners, attracting a combined influx of approximately $870 million.

On Wednesday, BlackRock’s IBIT experienced a substantial inflow of $586.5 million, whereas Fidelity’s FBTC recorded a remarkable influx of $281.5 million.

However, there was a decrease in the inflow of funds into the VanEck Bitcoin ETF (HODL), which decreased from $82.9 million the day before to $16.5 million.

Nevertheless, VanEck experienced a significant influx of more than $200 million during the initial two days of the week after it was determined to waive fees, reducing them from 0.20% to 0%, on the initial $1.5 billion in assets until March 2025.

On the other hand, Grayscale’s Bitcoin ETF (GBTC) witnessed a resurgence in outflows, amounting to $276.5 million, following a decrease to $79 million in outflows the previous day.

Bitcoin Price Soars Amid Market Optimism

Achieving its highest single-day net inflow since its inception on March 12, the U.S. Spot Bitcoin ETF also reached a remarkable milestone.

On March 12, the 10 Bitcoin ETFs saw their second-highest volume day, aggregating $8.5 billion, which contributed to a net inflow of $1.05 billion into U.S. Spot Bitcoin ETFs, as previously reported.

Meanwhile, these occurrences coincide with a fresh peak in Bitcoin’s price, thereby emphasizing the increasing scrutiny of the cryptocurrency market by participants on Wall Street.

Analysts ascribe the recent upswing in Bitcoin price to the surge in ETF inflows, which indicates increased institutional interest in digital assets.

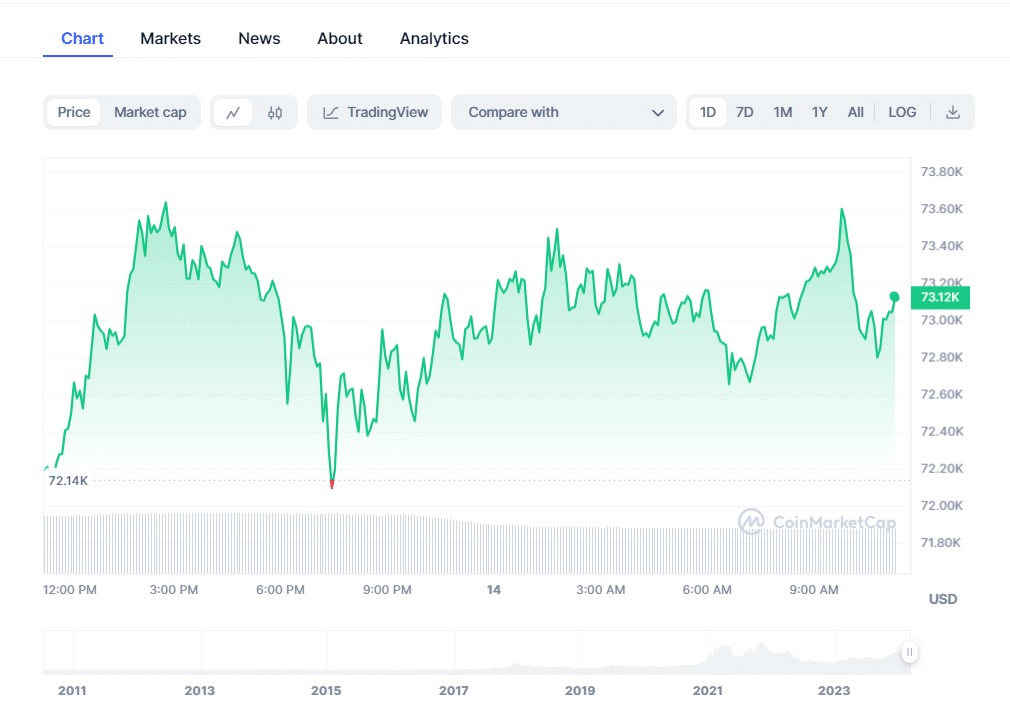

The Bitcoin price increased 1.35% to $73,123.31 at the time of writing, while its trading volume decreased 20.3% from yesterday to $48.36 billion.

However, the cryptocurrency has experienced its highest point of $73,641.04 today, after falling to $71,720.18 within the last 24 hours.

Notably, the BTC price had increased by nearly 50% over the last 30 days at the time of writing, with a weekly increase of approximately 11%.