The crypto market has experienced one of its harshest weeks in 2024, and Bitcoin (BTC) and Ether (ETH) transaction fees have plummeted to their lowest levels in several months.

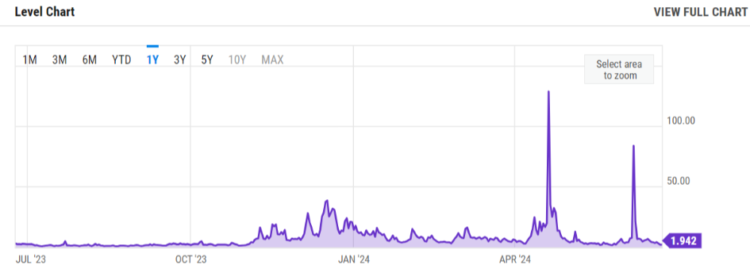

The average Bitcoin transaction fee reached $1.93 per transaction on June 23, the lowest level since October 2023. The Bitcoin network’s low gas fee indicates diminished network activity and reduced competition.

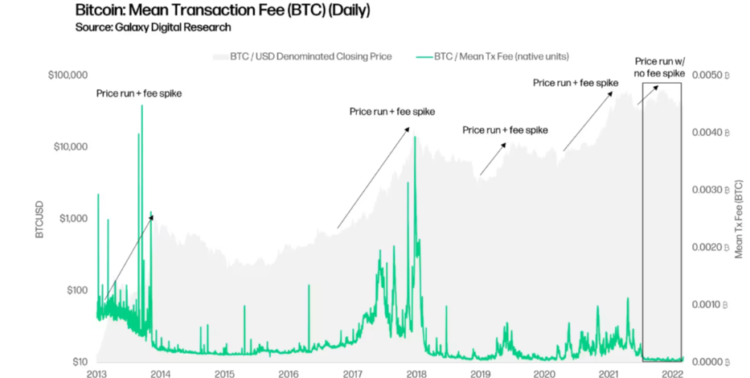

Transaction fees on the Bitcoin network frequently increase during periods of high market volatility, particularly when prices increase. The competition for block space is intensifying due to the heightened price speculation.

Consequently, a fee increase has been associated with each significant bullish period since 2012, except the 2021 bull run, during which the Bitcoin BTC price reached $69,000 despite the relatively low transaction fees.

Ethereum gas fee approaches historic lows

Conversely, Ether gas fees have reached a new low, with gas prices as low as 1 gwei, the lowest in years. The Ethereum network’s current gas fee is approximately 4.5 gwei.

The Ethereum network employs Gwei, a denomination of Ether, to facilitate purchasing and selling products and services. One gwei is equivalent to one billionth of one ETH.

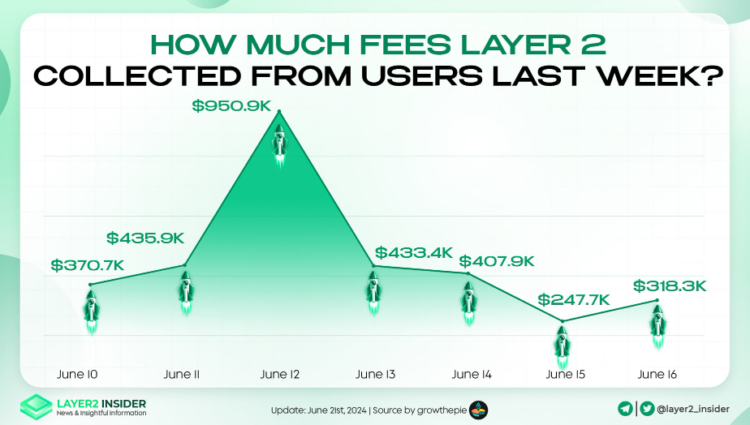

The low gas fee on Ethereum results from the migration of activity from the base layer to the layer 2 network following the March Dencun upgrade.

The average gas prices on Ethereum have decreased by approximately 92% since the Dencun upgrade. The Layer 2 networks earned $950,000 last week, according to a report from Layer 2 Insider.

Chaos in the crypto market

At a time when the cryptocurrency market is experiencing one of its most challenging weeks of 2024, the top two cryptocurrency networks are offering low transaction fees. The price of Bitcoin plummeted below the $63,000 price support, while several altcoins experienced double-digit losses.

The crypto market has experienced a substantial increase in the past six months, with Bitcoin and a few other cryptocurrencies reaching new all-time highs.

Nevertheless, the bears have been in control over the past few weeks, liquidating billions from the leveraged market while spotholders also suffered significant losses.