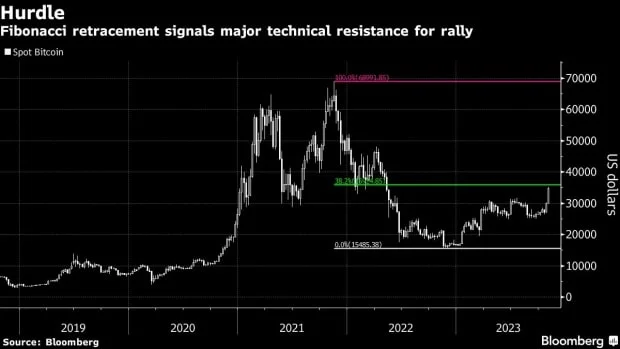

According to Fibonacci ratios, Bitcoin confronts obstacles just below $36,000, with RSI levels indicating a “overbought” state.

After reaching a 2023 high of $35,000 earlier this week, the Bitcoin price has been consolidating around $34,500 as investors continue to ride the bandwagon.

Will Bitcoin Price Continue to Rise?

The increase in Bitcoin’s value can be attributed to the anticipation that the first US exchange-traded funds (ETFs) that invest directly in the cryptocurrency will shortly be approved. Currently, the central question is whether the actual sanction of ETFs will prompt some investors to take profits.

Consequently, BTC continues to confront the litmus test of whether the rally will continue after the arrival of the spot Bitcoin ETF on the US market. Bloomberg was informed by Hayden Hughes, co-founder of social-trading platform Alpha Impact.

“Markets have priced in a Bitcoin spot ETF approval and I expect a sell-the-news event if it’s approved”.

This week, the leading digital currency increased by 16% and momentarily surpassed $35,000, a level not seen since 2022. In contrast, global stock markets are underperforming due to rising long-term Treasury yields and intensifying geopolitical uncertainty.

Due to current macro conditions, Bitcoin and cryptocurrencies have deviated from other risk-ON assets, such as US equities. However, seeing how far Bitcoin continues to outperform US equities will be intriguing.

Technical Tests and Derivatives of Bitcoin

Just below the $36,000 level, data Fibonacci ratios indicate a potential challenge for the Bitcoin rebound. This region is delineated by the 38.2% Fibonacci retracement of Bitcoin’s one-year decline until November 2022.

The weekly relative strength index (RSI), a momentum indicator for Bitcoin, recently surpassed 70 for the first time since 2021. An RSI above 70 is typically regarded as “overbought,” indicating a lower likelihood of experiencing swift rallies than the recent 10% intraday gains.

According to data from Deribit, the largest cryptocurrency options exchange, bullish bets on BTC reaching $40,000 by the end of the year have amassed significantly. This would represent a 16% price increase over the current levels.

Alternatively, Bitcoin has diverted attention away from gold during the recent rally. Mike McGlone, Senior Macro Strategist at Bloomberg, believes the relationship between Bitcoin and gold is changing.

With a crypto-to-gold multiple of approximately 10x until 2020, the previous resistance level may be undergoing a more permanent transformation. The imminent approval of spot Bitcoin ETFs in the United States will further solidify Bitcoin’s position as it increasingly enters the mainstream, possibly eroding gold’s relative status.