There is no amount of FUD that can keep Btc from rising, and China’s ban on cryptocurrency has once again boosted bulls.

After 150 days, China has stopped Bitcoin mining, and the price of Bitcoin has only risen as a result of this decision.

Chinese authorities created quite a stir five months ago when they announced a reaffirmation of their hostile environment policy regarding cryptocurrencies. This was a significant, but not unexpected, development.

Bitcoiners to the Chinese government: Thank you for the ban. China’s move against miners caused brief price volatility, matching the largest physical upheaval in Bitcoin’s history, just as it had done with every other “ban” before it.

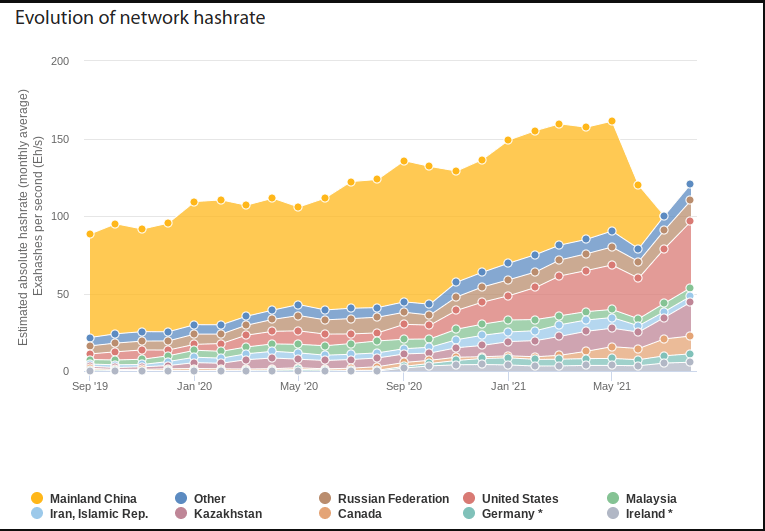

As miners shut down and migrated out of China, Bitcoin’s network hash rate dropped by half, with difficulty gradually adapting to the new conditions over the following months.

Although a tremendous revival has happened since then, the network and its security have almost eliminated all traces of China’s influence from today’s network. In the meantime, the price of bitcoin is showing a clearer pattern.

China prohibited Bitcoin transactions and mining only 150 days ago, according to analyst Willy Woo, who provided a summary of the incident.

“Today the network is more decentralised than ever and price has risen +50% . Antifragile.”

The hash rate data also demonstrates how China’s absence has strengthened decentralization, removing a stumbling block that had plagued the mining industry for years.

The hash rate data also demonstrates how China’s absence has strengthened decentralization, removing a stumbling block that had plagued the mining industry for years.

Woo had recognized the positive aspects of China’s mining restriction before the value of bitcoin/dollar had even begun to rebound, jokingly referring to China’s efforts as “selfless.”

Meanwhile, the United States is currently considered to be the greatest member in terms of the Bitcoin network’s hash rate, according to current estimates.

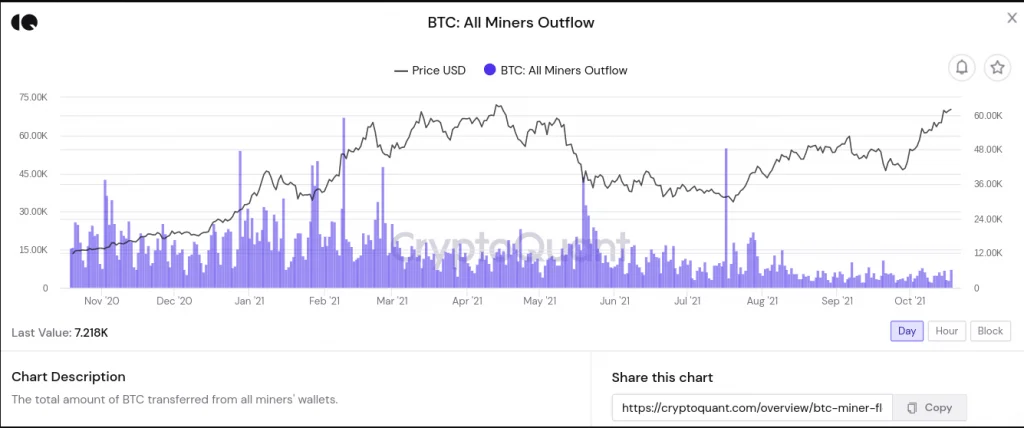

The current conduct of miners demonstrates the long-term perspective that network members have adopted after China withdrew.

Despite the fact that Bitcoin’s price is approaching all-time highs, miner outflows remain modest, and their reserves are at historic lows, according to data from on-chain analytics firm CryptoQuant.

Both miners and long-term hodlers are reluctant to sell at present prices, despite expectations of fresh highs and a blow-off peak of up to $300,000 for bitcoin/dollar in the near future.