In the first quarter, Jack Dorsey’s fintech company Block reported an astounding $2.16 billion in Bitcoin revenue from its flagship product, Cash App.

According to a shareholder letter announcing its Q1 2023 earnings, Block (NYSE:SQ) reported that its Bitcoin revenue was up 18% from $1.83 billion in Q4 and 25% from Q1 2022. Bitcoin revenue is defined as the total sales of the cryptocurrency to customers.

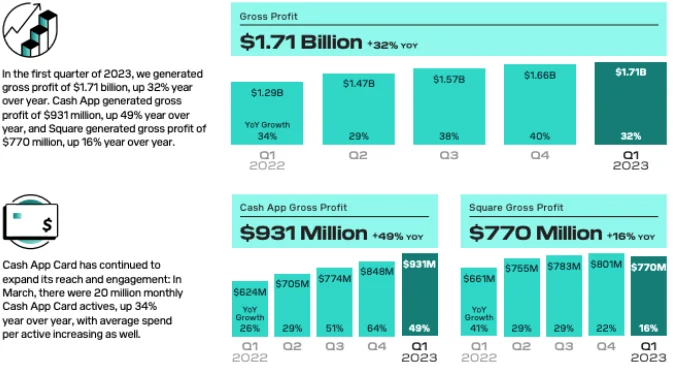

In the first quarter of 2023, Cash App’s total profits surpassed $931 million, representing a 49% increase year-over-year. Notably, Cash App’s profit paled compared to the company’s $1.71 billion in gross profit. Additionally, Block owns the superior business payment service Square, which reported a slight (3.8%) decline in earnings from the fourth quarter of 2022.

According to the shareholder letter, the multibillion-dollar Bitcoin revenues were propelled by “an increase in the quantity of Bitcoin sold to customers.” They were “partially offset” by a decrease in the market price of Bitcoin compared to the same period in 2022.

Additionally, the fintech company reported a profit per share of 40 cents, exceeding analyst expectations of 35 cents per share by 14%, while its first-quarter revenue increased 26% year-over-year.

During the earnings conference call with investors, Block CEO Jack Dorsey identified artificial intelligence and “open protocols” as technologies that would help the company respond proactively to “significant shifts” in the global financial system. He cited continued bank failures in the United States and de-dollarization as the primary causes.

The equity market was receptive to Block’s earnings reports. In after-hours trading, the share price of the fintech company momentarily surged 5% to $63.50 before settling for a 2.5% gain at the time of publication.

This increase marked the first respite from Block’s share price’s gradual decline, precipitated by the publication of a scathing report by renowned short sellers Hindenburg Research.

On March 23, Hindenburg criticized Block for “systematically taking advantage of the demographics it claims to be helping” and for its “willingness to facilitate fraud against consumers and the government.” Hindenburg added that Cash App’s success depended on Block’s “willingness to facilitate fraud against consumers and the government.”

In response to Hindenburg’s allegations, Block wrote, “Hindenburg is notorious for these attacks, designed solely to allow short sellers to profit from a declining stock price.” “After reviewing the entire report in light of our data, we believe it is intended to mislead and confuse investors.”