Legislators from the United States reportedly urged the Securities and Exchange Commission to permit trading options on exchange-traded products (ETPs) involving Bitcoin.

Axios reports that in a recent letter to the commission’s chief, Gary Gensler, Representatives Mike Flood and Wiley Nickel urged the SEC to cease discriminating against cryptocurrency funds.

The bipartisan letter states, “We strongly urge you to approve spot Bitcoin ETP options immediately or to explain the Commission’s differential treatment of options for Bitcoin futures ETFs, which are presently trading, and options for spot Bitcoin ETPs.”

Financial instruments known as options grant the purchaser the privilege, without imposing any obligation, to purchase or sell a specific asset—Bitcoin, in this instance—at a predetermined price by a specified date.

Hedging against price fluctuations, limiting potential losses, and facilitating the generation of additional income by investors via strategic approaches are all typical applications of this instrument.

Flood and Nickel contend that the approval is vitally essential for the investors that the SEC “seeks to Protect.”

The agency has been delaying decisions on January applications submitted by the New York Stock Exchange, Nasdaq, and Cboe Global Markets.

Nasdaq has applied to list and trade options on iShares Bitcoin Trust by BlackRock, whereas Cboe plans to offer options trading on various BTC funds. Similarly, the NYSE plans to trade options for Grayscale Bitcoin Trusts, Bitwise Bitcoin ETF, and any other trusts that hold Bitcoin.

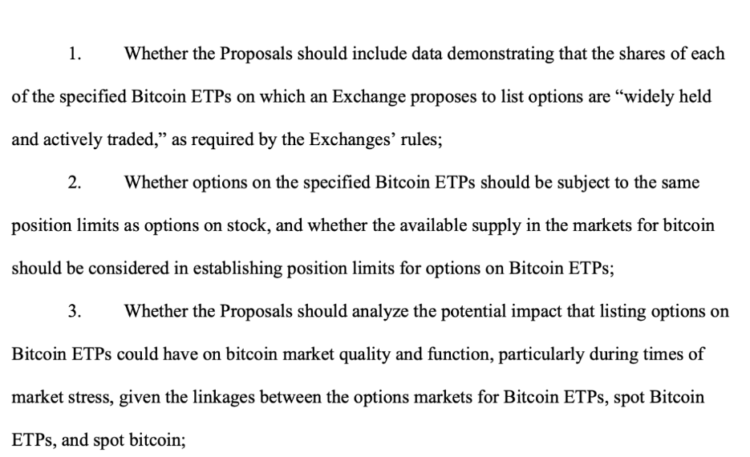

The commission has recently commenced a fresh round of consultations regarding the proposed rule change that would allow for trading options on Bitcoin funds.

As stated in a filing dated April 24, the SEC intends to investigate the potential influence of Bitcoin options on market stability, specifically during periods of volatility.

Additionally, the agency is investigating whether current enforcement and market surveillance practices are adequate to manage the complexities of Bitcoin options. The deadline for participants to submit initial remarks is May 15, and the deadline for rebuttal comments is May 29.