To increase eNaira adoption, the Central Bank of Nigeria (CBN) is redesigning it and has raised the interest rate from 18.5% to 18.75% to fight the growing inflation.

The eNaira, Nigeria’s CBDC, was launched in October 2022 as a digital version of The Naira, Nigeria’s national currency.

The digital currency is meant to facilitate faster, cheaper, and more inclusive payments for Nigerians, especially the unbanked and underbanked population.

However, the eNaira has faced several challenges in gaining traction among Nigerians.

Despite having over 13 million eNaira wallets registered between October 2022 and March 2023, the usage rate remains low for a country with a population of nearly 224 million.

The value of eNaira transactions up to March 2023 was 22 billion naira ($48 million), a small figure considering Nigeria’s $220 billion informal economy that largely relies on cash.

Moreover, the country lacks the necessary infrastructure for widespread eNaira use, with few merchants accepting the digital currency.

CBN Upgrades eNaira App and Model

To address these issues, the CBN has decided to upgrade the eNaira app and model to make it more attractive and user-friendly for Nigerians.

The CBN has not disclosed the specifics of the changes, but it has said that it will enable contactless payments through the app, which could enhance the convenience and security of transactions.

The CBN has also said that it will modify the eNaira model to encourage more usage of the digital currency. The current model is based on a tiered system, where users have different limits and requirements depending on their verification level.

The bank may relax some of these restrictions or offer more incentives for users to adopt the eNaira.

The CBN’s strategy is focused on the low transfer fees as a means to attract Nigerians to use the eNaira, particularly the younger demographic who have shown interest in startups that offer digital financial services.

However, it seems that Nigerians value other factors more than the cost of transfers, such as convenience, trust, and utility.

CBN Hikes Interest Rate to Curb Inflation

In another significant development, the CBN’s Monetary Policy Committee (MPC) also increased the Monetary Policy Rate (MPR), which measures the interest rate from 18.5% to 18.75%.

This decision, announced by Acting CBN Governor Folashodun Shonubi, marks the first MPC meeting and decision since President Bola Tinubu took office on May 29, 2023.

The CBN has been raising the interest rate since November 2022 to curb inflation, despite Tinubu’s campaign promise to reduce interest rates.

The hike in the MPR comes as Nigeria grapples with rising inflation, which erodes the purchasing power of Nigerians and affects their living standards.

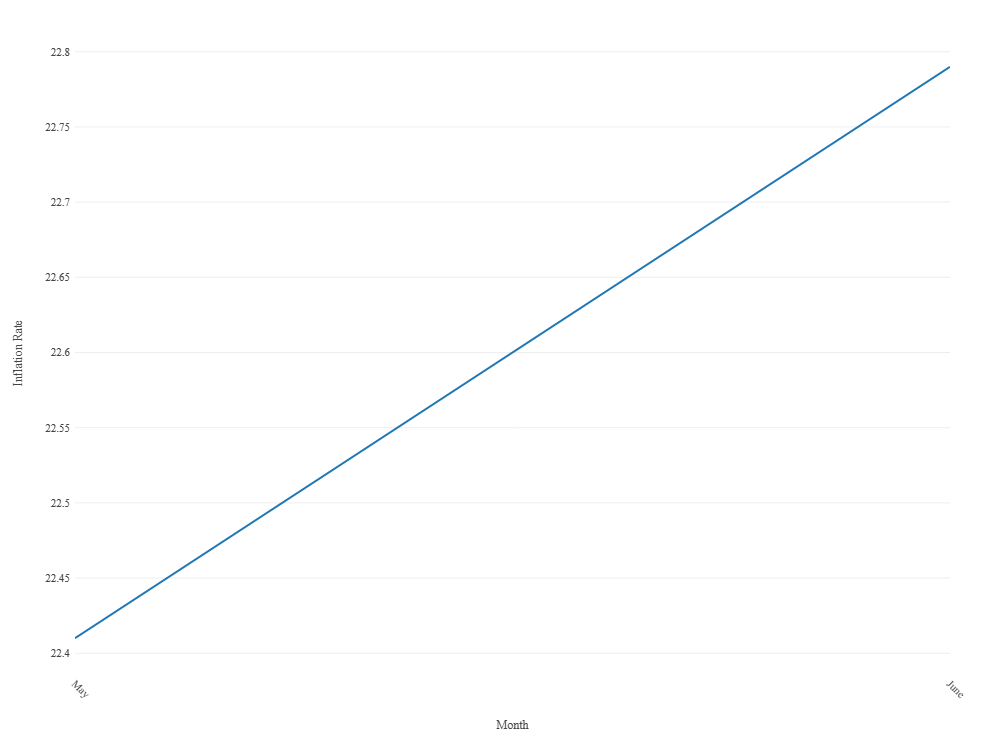

According to the National Bureau of Statistics (NBS), Nigeria’s headline inflation rate rose from 22.44% in May to 22.79% in June 2023. This figure is 4.19% higher than the rate recorded in June 2022, underscoring the country’s ongoing economic challenges.

The CBN’s recent decisions reflect the challenges facing Nigeria’s economy and the efforts to promote the use of eNaira as a digital alternative to cash.