Celsius Network‘s native token experienced a more than 300% increase in value within a month of implementing a $2.5 billion repayment scheme for over 250,000 creditors.

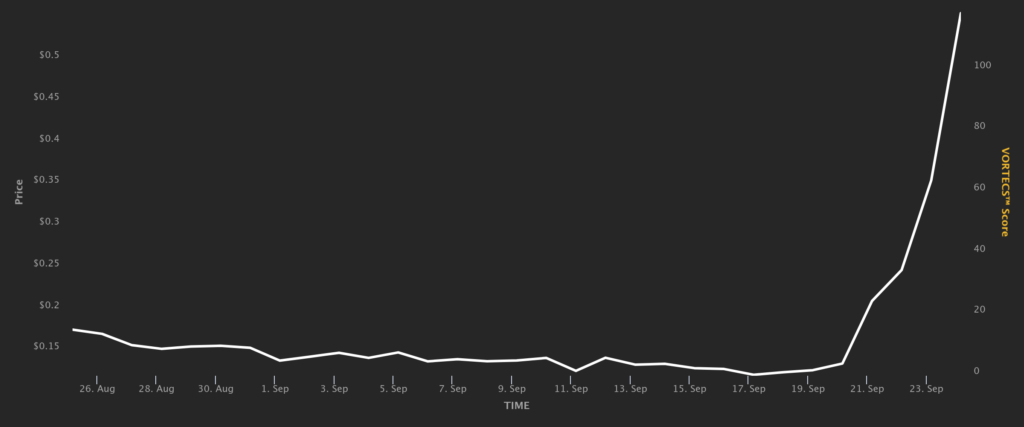

The insolvent digital asset lender had repaid approximately $2.53 billion to 251,000 creditors, according to a court filing on August 26. The Celsius (CEL) token was trading at $0.16 on that day, according to Cointelegraph Markets Pro data.

The token’s price reached $0.65 on September 23, representing a 300% increase in value. At present, the token is trading at approximately $0.58.

Although there was some recovery in the token’s price, it remains 1,287% lower than its all-time peak of $8.05 in June 2021.

Celsius pays $2.5 billion to creditors

Celsius paid a total of $3 billion, which is approximately 84% of the assets owed, on August 26. Although the majority of creditors have already been compensated, not all those who are eligible for payment are seeking to claim their digital assets because some of the amounts owed are negligible.

The filing stated that 64,000 of the remaining creditors who have to claim their crypto have assets worth less than $100. Concurrently, 41,000 individuals are overdue between $100 and $1,000 in cryptocurrency.

The filing stated that the tiny amounts at issue for many creditors may be why they have yet to claim their funds. “They may not be motivated to take the necessary steps to claim a distribution successfully,” the filing stated.

The bankruptcy administrator also stated in the filing that it had already attempted to distribute over 2.7 million dollars to eligible creditors.

End of Celsius bankruptcy saga

Celsius declared bankruptcy in July 2022. In an email to its users, the organization disclosed that it had submitted petitions for Chapter 11 reorganization, and several days had passed since the platform employed bankruptcy attorneys.

With respect to the United States Federal Trade Commission, the bankruptcy resulted in sanctions of up to $4.7 billion. The corporation expressed satisfaction with the resolutions it achieved with various regulatory agencies in the United States.

Additionally, the company’s former CEO, Alex Mashinsky, was apprehended and charged by prosecutors with financial fraud, misleading consumers, and manipulating the token’s price.