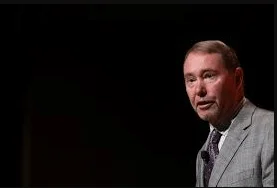

Jeffrey Gundlach, the CEO of DoubleLine estimates the decline in the value of US Dollar to be $23k.

In the long run, Jeffrey Gundlach, the CEO of investment management firm DoubleLine, suggested that Bitcoin could have more positive activity than the U.S. dollar.

Gundlach stated in a Wednesday interview with CNBC’s Halftime Report that he believes individuals will soon be able to purchase Bitcoin (BTC) for less than $23,000 due to the likelihood of the cryptocurrency creating a head-and-shoulders trading pattern.

He appeared to be alluding to a “head” when the BTC price peaked at more than $64,000 on April 13 and “shoulders” during the early January surge to more than $40,000 and subsequent decline to the $30,000s.

“I’m not a big believer in head-and-shoulders tops but this one looks pretty convincing,” said Gundlach. “Turning neutral at $23,000 was obviously too early, but I’ve got a feeling you’re going to be able to buy it below $23,000 again.”

In spite of the fact that the billionaire declared himself optimistic on Bitcoin early last year, he has always considered it to be a “highly speculative and highly volatile” commodity, describing the current price chart as “pretty scary.” While volatility would suggest both price increases and price decreases, Gundlach’s outlook for the United States currency beyond this year appeared to be more pessimistic.

The CEO of DoubleLine said that the United States’ trade and budget deficits, which have both increased as a result of the ongoing pandemic’s economic fallout, might cause the dollar to “fall pretty substantially.” He went on to say:

“In the short term, the dynamics have been and will continue to be in place for the dollar to be marginally or moderately stronger. In the longer term, I think the dollar [is] doomed.”

According to MarketWatch’s dollar index, the dollar was trading at 92.64 at the time of publication, having gained almost 0.25 percent over the previous 24 hours. Bitcoin’s price has dropped by almost 4% to $31,436 USD today.

Gundlach, dubbed the “Bond King” by many, has previously stated that Bitcoin, along with gold, is a decent inflation hedge, although he has highlighted reservations about the traceability of digital currencies.

DoubleLine presently has more than $135 billion in assets under management — none of which, according to reports, contains cryptocurrency — and the company’s CEO has stated that he personally does not “believe in Bitcoin.” —

“I’ve never been long Bitcoin personally, I’ve never been short, it’s just not for me,” said Gundlach. “I don’t have that kind of risk tolerance in my DNA where I have to get worried to pull up the quote every day to see if it’s down 40%.”