USDC is now available in Brazil and Mexico’s banking systems, allowing businesses to use the USD-pegged stablecoin directly through local financial institutions.

Circle has integrated its USD-pegged stablecoin, USD Coin (USDC), with Brazil and Mexico’s national real-time payment systems.

In a Sept. 17 announcement, Circle revealed that USDC is now accessible within the banking systems of both countries.

According to Circle, this integration enables businesses to directly obtain USDC through local financial institutions without international wire transfers.

Companies can utilize the stablecoin for corporate purposes and offer it to retail customers.

“Eliminating international wires can drastically reduce the time it takes to access USDC – from days to just minutes, releasing capital trapped in the lengthy settlement processes,” the company stated.

The integration allows USDC access in local fiat currencies, such as the Brazilian Real (BRL) and Mexican Peso (MXN). It also means a digital dollar is now integrated into Brazil’s PIX and Mexico’s SPEI payment systems.

Brazil’s central bank introduced PIX in 2020, facilitating real-time transactions 24/7 for individuals, businesses, and government entities using a phone number. As of August 2024, over 168 million people in Brazil were using PIX.

Similarly, Mexico’s SPEI system allows real-time money transfers between banks via mobile apps or online banking. The system, in operation for 20 years, processed nearly 3.3 million transactions in 2023.

Circle’s expansion into Latin America aims to increase involvement in cross-border transactions, a key use case for stablecoins.

The company noted that remittances from the U.S. to Mexico reached $63 billion in 2023, up 7% from 2022, making up about 4% of Mexico’s economy.

Mexico is one of the U.S.’s largest trading partners, with over $800 billion in goods and services traded annually.

In Brazil, around 95% of its $640 billion in annual foreign trade is conducted in dollars, including $120 billion in direct trade with the U.S.

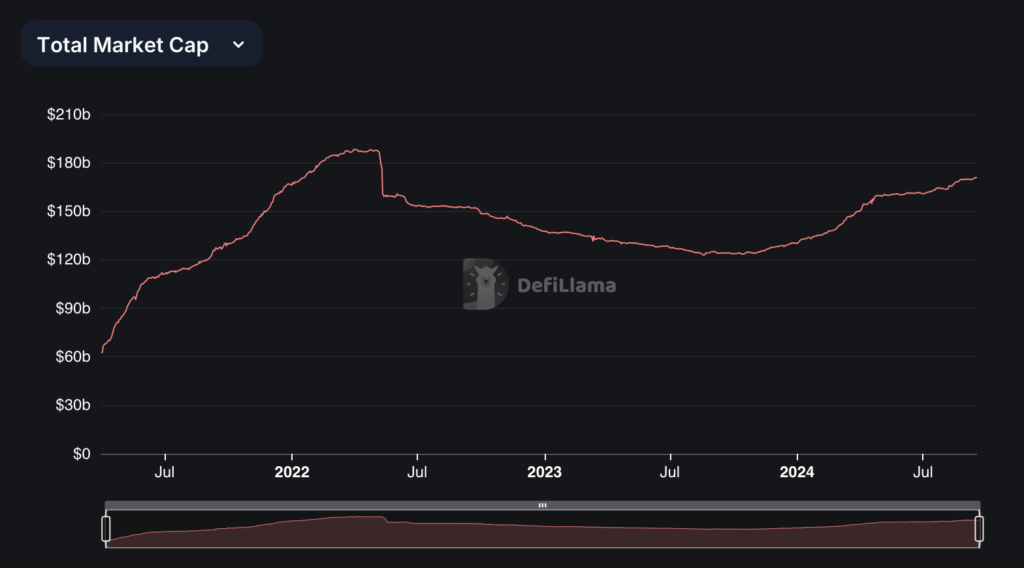

According to DefiLlama data, USDC has a market capitalization of $35 billion, trailing behind Tether, which has a market cap of $118 billion at the time of writing.