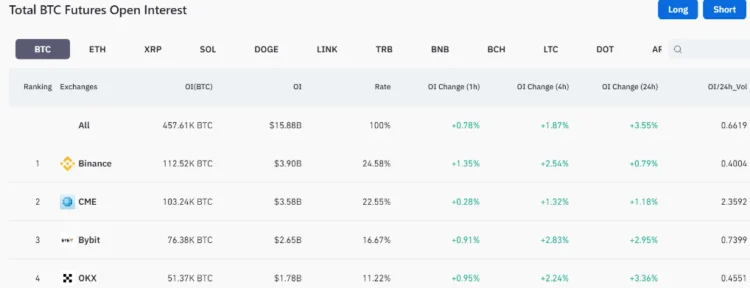

The Chicago Mercantile Exchange (CME), a regulated derivatives exchange that lists Bitcoin futures, now ranks second on the list of BTC futures exchanges in terms of notional open interest.

On October 30, open interest at the CME reached $3.58 billion, propelling the regulated derivatives exchange platform up two positions from the previous week.

The CME surpassed Bybit and OKX in open interest with $2.6 billion and $1.78 billion, respectively, and is within a few million of Binance’s $3.9 billion.

CME’s conventional Bitcoin futures contract is worth five BTC, whereas the micro contract is worth one-tenth of a Bitcoin. The primary focus of open interest on offshore exchanges is perpetual futures rather than traditional futures contracts, as they have no expiration date and use the funding rate method to maintain price parity with the market price.

Open interest in Bitcoin refers to the total number of outstanding Bitcoin futures or options contracts. It measures the quantity of funds invested in Bitcoin derivatives at any given time. Open interest measures the market’s capital inflow and outflow.

Open interest will increase if more capital flows into Bitcoin futures. However, the genuine interest will decrease if capital flows out. Consequently, an increase in open interest reflects an optimistic sentiment, while a decrease in open interest indicates a bearish sentiment.

The CME’s increasing open interest not only propelled the regulated futures exchange to second place among futures crypto exchanges but also caused the volume of its cash-settled futures contracts to surpass 100,000 BTC.

The growing interest of traders in the Bitcoin futures market has also helped the CME obtain a 25 percent market share in the Bitcoin futures industry.

Most investment in CME futures has been through standard futures contracts, indicating an influx of institutional interest as Bitcoin registered a massive double-digit increase in October, enabling it to reach a new 12-month high above $35,000.