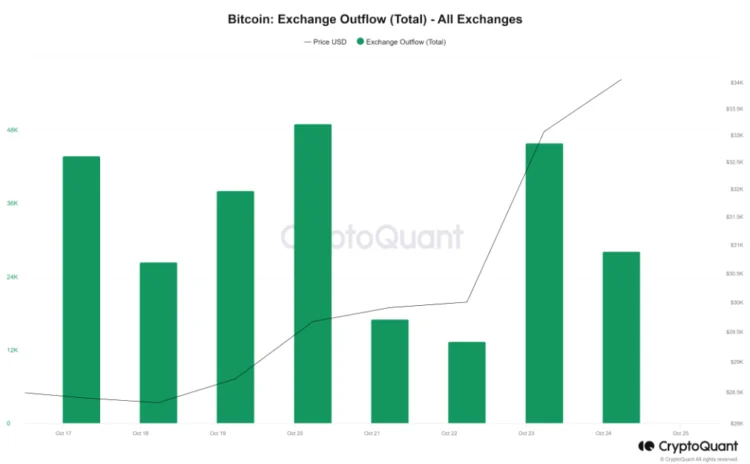

On October 24, the price of Bitcoin briefly surpassed $35,000 for the first time in a year, causing major crypto exchanges to register a net outflow of assets and traders moving their assets away from exchanges.

The movement of funds away from exchanges is considered a bullish indicator, as it indicates that traders are transferring their assets to secure storage in anticipation of a price increase.

According to data provided by crypto-analytics firm CoinGlass, over $500 million left Binance over the past 24 hours, followed by $49.4 million from crypto.com and $31 million from OKX. Most other exchanges recorded outflows of less than $20 million.

Recent outflows from cryptocurrency platforms have prompted concerns of a “bank run” following the collapse of the FTX in November 2022.

However, the most recent outflows correspond more with investor sentiment than fear-driven withdrawals at the zenith of the bear market. Glassnode data confirms that Bitcoin outflows from exchanges have increased with BTC’s price increase over the past few days.

The price increase also led to liquidating short positions worth approximately $400 million. In the past twenty-four hours, 94,755 traders liquidated derivative positions. The largest single liquidation order, worth $9.98 million, occurred on Binance.

On-chain analysts also referenced the market value to realized value (MVRV) ratio, which compares the asset’s market value to its realized value—calculated by dividing a cryptocurrency’s market capitalization by its realized capitalization.

The realized price is the average price at which each coin or token was last traded on-chain. Currently, the MVRV ratio stands at 1.47. When the previous bull run occurred, the MVRV ratio was 1.5.

In the past twenty-four hours, the total crypto market capitalization has increased by over 7.3% to $1.25 trillion, its greatest valuation since April. It is believed that increased speculation surrounding the introduction of a spot Bitcoin exchange-traded fund fueled the increase.